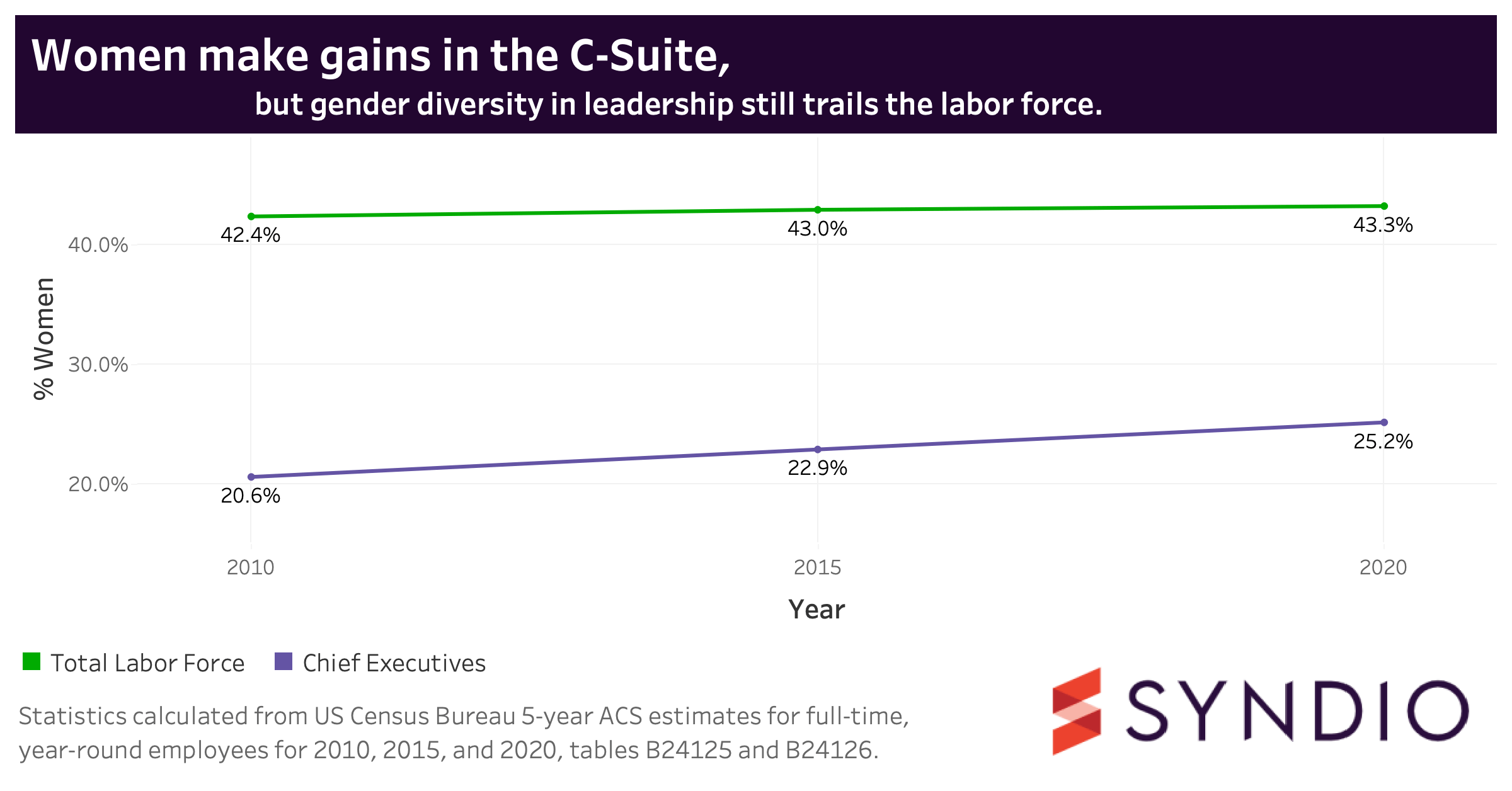

The calls to increase the number of women in senior-level roles are growing, but are companies making progress?

The latest Census data released this week shows that female representation in the C-Suite continued to see only modest gains. In 2010, women represented 20.6% of the C-Suite. In 2015 they were 22.9%, and now the most recent data show women at 25.2% — steady increases of 2.3 percentage points every five years. However, women are still under-represented in top jobs relative to their share of the workforce, which sits at 43.3%.

The slow gains and latest findings come amidst a backdrop of increased legislative and investor pressure to close the median pay gap and increase gender representation across all levels, particularly for women in the C-Suite and upper management.

In California, legislators introduced the first ever bill to compel companies to publicly disclose their median pay gap even though California already has one of the smallest gender pay gaps in the nation at 88¢, and ranks 17th among states in terms of executive opportunity gaps for women.

Additionally, in the last couple weeks, some of the biggest corporations in America held proxy votes to force reporting of their median pay gaps. In part, investors are responding to the realization that under-representation of women in management and leadership positions is a primary driver of pay gaps across an entire organization.

Apple’s shareholders barely voted to uphold the company’s recommendation that they not be required to report median pay gaps, and in another recent well-publicized example, shareholders voted for the company to report both their median and adjusted pay gaps across race and gender.

The pressure is not abating anytime soon. Engine No. 1, the investment firm that famously won three Exxon Board of Director seats, explains why:

“You saw the way something can go from being seen as a gadfly proposal to being truly understood as a core value-driver,” said Michael O’Leary, who oversees investment stewardship at the San Francisco-based firm. “Just as with climate, we expect to see that spread to other issues like the workforce, and racial diversity.”

And as the latest Census data indicates, increased pressure might impact the rate at which C-Suite diversity catches up with increasing labor force diversity.

Chris Martin is a Research Economist at Syndio, the leading company dedicated to workplace equity. He holds an MA in Economics from the University of Washington.