In 2021, many pay scale disclosure laws morphed, with laws in Connecticut, Nevada, Rhode Island, and Colorado requiring proactive disclosure of pay scale information. These laws were far different from the earlier laws in places like California, Maryland, Cincinnati and Toledo, Ohio, and Washington State that only required reactive disclosure. And 2022 kicked off with New York City’s new pay scale disclosure law requiring employers to disclose pay ranges for all job postings.

Many organizations aren’t yet prepared to meet these kinds of requirements — but rest assured, they’re coming to a city, state, or country near you. So, what do you need to know about this new pay scale disclosure law in New York City? Below, we answer the most common questions our team has been receiving about this law.

This post has been updated to incorporate the NYC Commission on Human Rights’ FAQs.

Who and what the New York City pay disclosure law applies to

Does “New York City” include all five boroughs?

Yes, NYC Regulations apply to all five boroughs — Manhattan, Brooklyn, Queens, Staten Island, and The Bronx.

Is the requirement only for posted transfers/promotions? Does this apply to non-applied-for internal promotions?

The NYC requirement to post the pay range is only for posted hires, transfers, or promotions. Unlike Colorado’s Equal Pay for Equal Work Act, the NYC pay scale disclosure law does not have any promotional opportunity disclosure rule. The NYC law applies only when an employer “advertise[s]” a role and the range needs to be provided “in [the] advertisement.”

What’s the best practice for posting a position when the role can be remote or work in our NYC office? Does it apply to employees who live in NYC but work in other cities/counties? What if our headquarters are in NYC but we have employees all over the US?

NYC officials have said the law will apply broadly, including to some remote employees.

During the hearing on this legislation on December 2, 2021, JoAnn Kamuf Ward, Deputy Commissioner of Policy and External Affairs at the NYC Commission on Human Rights, and Katherine Greenberg, Assistant Commissioner in the Law Enforcement Bureau of the NYC Commission on Human Rights, testified.

Ms. Greenberg said the New York City pay disclosure law will apply “if the impact of the discrimination will be felt in New York City,” which will likely include people who are working in the city remotely, people who are performing work at an employer’s location in the city, and employees for whom their regular work takes them into NYC to perform work.’

This was confirmed in the NYC Commission on Human Rights’ FAQs, which provided: “Covered employers should follow the new law when advertising for positions that can or will be performed, in whole or in part, in New York City, whether from an office, in the field, or remotely from the employee’s home.

Because the NYCHRL’s protections extend to many groups of workers, postings are covered regardless of whether they are seeking full- or part-time employees, interns, domestic workers, independent contractors, or any other category of worker protected by the NYCHRL.”

When are companies obligated by law to post the salary range in NYC?

The law applies to employers with at least four employees. The FAQs prepared by the NYC Commission on Human Rights provided that the law applies to: “All employers that have four or more employees or one or more domestic workers are covered by the New York City Human Rights Law (NYCHRL), including this new provision of the law.

As with other provisions of the NYCHRL, owners and individual employers count towards the four employees. The four employees do not need to work in the same location, and they do not need to all work in New York City. As long as one of the employees works in New York City, the workplace is covered.”

Like Colorado, if NYC employees can see a remote job posting, would a salary range be required?

NYC officials have said the New York City pay disclosure law will apply broadly, including to some remote employees. This will follow the same jurisdictional analysis in this context that is used in other NYC Human Rights Law. However, if the role has no connection to NYC (e.g., hiring occurs in Chicago and the role sits in Chicago), the law is unlikely to apply. Also, residency in NYC alone is generally not enough to establish impact in NYC. The FAQs issued by the NYC Commission on Human Rights provide: “Covered employers should follow the new law when advertising for positions that can or will be performed, in whole or in part, in New York City, whether from an office, in the field, or remotely from the employee’s home.”

If I have no intention of hiring someone in our NYC office, do I have to list the pay information on my posting? For example, if the job is for my Chicago office.

If the role has no connection to NYC (e.g., hiring occurs in Chicago and the role sits in Chicago), the law will not apply.

Are the disclosure obligations different for federal contractors?

The rules are not different for federal contractors in the NYC pay scale disclosure law. However, the law may impact federal contractors slightly differently. This is because the requirement to post ranges is only for posted new hires, transfers, or promotions. As federal contractors are required to post most external roles because of Office of Federal Contract Compliance Programs (OFCCP) requirements — with limited exceptions for internally-filed roles, some senior-level roles, and roles lasting less than three days, for example — federal contractors may be obligated to post more roles.

Salary range definition

How is “pay range” defined? Can I choose the definition (i.e., pay grade range, market-based range, internal pay range)?

“Pay range” is not defined in the New York City pay disclosure law. According to the law, it is the range within which you would reasonably, in good faith hire, promote, or transfer someone. The NYC Commission on Human Rights indicated in the FAQs that “good faith” means “the salary range the employer honestly believes at the time they are listing the job advertisement that they are willing to pay the successful applicant(s).” This range is not defined in compensation management terms, such as pay grade range or market-based range. Since this is going to be visible to employees, the challenge is that you will either need to be prepared to explain the difference or want to work to ensure the ranges are very similar and reflect both how you hire as well as how you currently pay employees.

When it comes to bonuses, commissions, and other jobs that are paid by productivity, what is required and how should organizations handle other aspects of total rewards, benefits, recruitment bonus, options for telework, etc.?

The law says that employers must post the “salary range.” The FAQs issued by the NYC Commission on Human Rights clarified that the NYC pay scale disclosure law applies just to base pay.

At the time the law was passed it was not clear whether this would just apply to “base salary” as one might suspect given the language or have a more broad application. At the December 2, 2021 hearing, Council Member Rosenthal asked the NYC Commission on Human Rights about the fact that it is unclear whether the law will apply just to “base salary” or also to “things that companies can add on” like bonuses, commissions, or other measures of productivity. The NYC salary history ban legislation (1 N.Y.C. Admin. Code § 8-107(1)) used the same “salary range” language, but that law was clear that it applied to other forms of compensation as well. However, the FAQs clarified it applies just to base salary.

The FAQs provide: “Salary does not include other forms of compensation or benefits offered in connection with the advertised job, promotion, or transfer opportunity, such as:

- Health, life, or other employer-provided insurance

- Paid or unpaid time off work, such as paid sick or vacation days, leaves of absence, or sabbaticals

- The availability of or contributions towards retirement or savings funds, such as 401(k) plans or employer-

funded pension plans - Severance pay

- Overtime pay

- Other forms of compensation, such as commissions, tips, bonuses, stock, or the value of employer-provided

meals or lodging

Employers may include additional information in advertisements about benefits and other forms of compensation offered in connection with the job, promotion, or transfer opportunity, even though that information is not required.”

How to structure your ranges

What stops an organization from posting a range from $1 to $1,000,000?

For the purposes of the law, the salary range reflects the range of pay within which you would reasonably expect to hire, promote, or transfer someone into a role. Posting a range from $1 to $1,000,000 would likely not be interpreted as being a “good faith” range under the law.

I have been concerned about using “market data.” If the environment is not equitably compensating for skills/experience, is using market data perpetuating the problem?

Solely using market data may not adequately take into account the manner in which a company internally values the impact of a given role. We see that companies that have an internal job evaluation system tied to the market are most successful in creating salary frameworks that are internally equitable and externally competitive.

We post ranges but not full bands. We use a 3-zone model and never hire people into the highest zone because we want room for people to grow within their bands. Is this still permissible or is it in violation now?

The law references the range someone would be hired, promoted, or transferred into for a given opening. Specifically, it says that employers provide “the minimum and maximum salary for a position,” which is defined as “the lowest to the highest salary the employer in good faith believes at the time of the posting it would pay for the advertised job, promotion or transfer opportunity.” So if you never hire, promote, or transfer someone into the highest range, then excluding the third zone may be reasonable.

For jobs that do not have a range (e.g., all directors are paid $100,000 in annual base salary), can companies just post $100,000 or must they create a range?

If there is lockstep compensation, you do not need to create a range for salary. You could post that the base pay is $100,000 – $100,000. This was confirmed by the NYC Commission on Human Rights’ FAQs, which noted: “Employers must include both a minimum and a maximum salary; the range cannot be open ended… If an employer has no flexibility in the salary they are offering, the minimum and maximum salary may be identical, for example, ‘$20 per hour.’”

What about geographic differences?

The law does not require that you differentiate on the range. That said, as a compensation best practice, we have seen some employers provide an explanation of how they derived the range. For example, the range was designed using data that are applicable to a specific region — so you are not accounting for employees who choose to live in lower or higher cost-of-labor markets.

What is the recommendation for multiple pay zones?

If a company uses geographic differentials for different markets, the only market requiring disclosure under the NYC law is this specific market. However, employers would be best-served by anticipating that employees in other markets will see the ranges. Some employers are considering providing the entire nationwide range.

If companies use one broad job posting to recruit multiple levels of talent, can you have a more broad range to reflect that? Or will job postings need to be restructured (i.e one posting for each level)?

This is an open question in NYC. The spirit of the law is to post ranges that are what you would reasonably hire, promote, or transfer someone into. The NYC law requires that employers provide “the minimum and maximum salary for a position,” which is defined as “the lowest to the highest salary the employer in good faith believes at the time of the posting it would pay for the advertised job, promotion or transfer opportunity.”

The FAQs issued by the NYC Commission on Human Rights provide that “Advertisements that cover multiple jobs, promotions, or transfer opportunities can include salary ranges that are specific to each opportunity.” However, the FAQs do not say that employers “must” do this.

Further, in Colorado, where they have already issued guidance, posting multiple levels within one role may potentially be compliant. The Colorado guidance provides: “An employer cannot post a $70,000-$100,000 range for a junior accountant position just because it pays senior accountants at the high end of that range. But it can post $70,000-$100,000 for an accountant if it does not limit the posting to junior or senior accountants, and genuinely might offer as low as $70,000 for a junior accountant, or as much as $100,000 for a senior one.” See this resource for more information.

Does the New York City pay disclosure law apply to all job advertisements?

The FAQ guidance from the NYC Commission on Human Rights provides that the law applies to any “advertisement,” which they define as “a written description of an available job, promotion, or transfer opportunity that is publicized to a pool of potential applicants. Such advertisements are covered regardless of the medium in which they are disseminated. Covered listings include postings on internal bulletin boards, internet advertisements, printed flyers distributed at job fairs, and newspaper advertisements. The law does not prohibit employers from hiring without using an advertisement or require employers to create an advertisement in order to hire.”

Salary range communication

When an organization provides the pay scale during the hiring process or at an applicant’s request, are laws set in place in jurisdictions with pay scale disclosure laws that differentiate between verbally expressing the pay scale versus written?

The laws are each a little unique. In NYC, this information must be included in the job advertisement, as noted above.

Do we have any disclosure obligations to current employees if we update pay ranges?

In a sense, the information will be available to current employees because it will be included on publicly-available job postings on the Internet. That said, the NYC pay scale disclosure law does not require proactively providing the updated range to internal employees who are not applying for promotions or transfers.

Some other state laws do, however, allow internal employees to request the wage range. For example, in Connecticut, employers must provide internal employees with the wage range for the employee’s position upon (a) the hiring of the employee, (b) a change in the employee’s position with the employer, or (c) the employee’s first request.

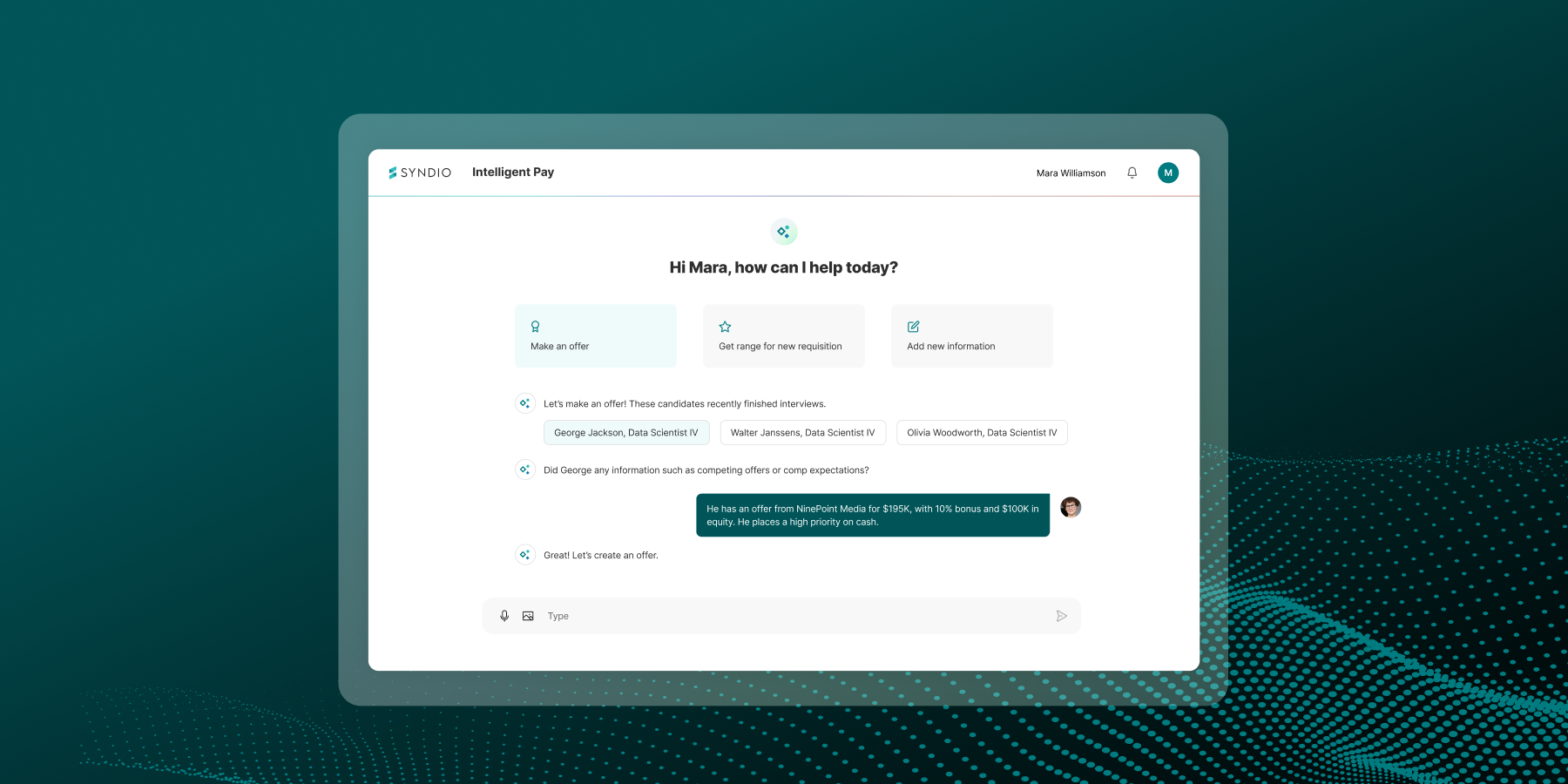

What guidance do you have for employers who are only now creating job structure/ranges and for the initial education for front-line managers?

We recommend you create a job structure and ranges that you are comfortable sharing as part of the job posting pay disclosure. The more transparency-ready you can be, the better. You can then invest time in educating your managers and employees around your compensation philosophy, how you define the market, how the ranges were created, and how they should be applied. Technology like Syndio’s workplace equity platform is your ally in creating these ranges.

Non-compliance

If we post a range but ultimately hire higher than the posted range, is that a problem?

The spirit of the law is to post ranges that are what you would reasonably hire, promote, or transfer someone into. The New York City pay scale disclosure law requires that employers provide “the minimum and maximum salary for a position,” which is defined as “the lowest to the highest salary the employer in good faith believes at the time of the posting it would pay for the advertised job, promotion or transfer opportunity.” So, if going in, your “reasonable expectation” is to hire in that range, this likely would comply.

NYC has not addressed this question specifically yet, but the Equal Pay Transparency Rules for the Colorado law do and provide at Section 4.1.2 that “an employer may ultimately pay more or less than the posted range, if the posted range was the employer’s good-faith and reasonable estimate of the range of possible compensation at the time of the posting.” See this resource for more information.

What are the ramifications if an organization doesn’t follow this new rule to the T? Does it involve fines or some sort of audit? Who is responsible for enforcing these rules in NYC and across states?

These vary by state. In NYC, not posting the salary range is considered an “unlawful discriminatory practice” under the NYCHRL and may result in civil penalties up to $125,000. Willful or wanton acts could result in penalties as much as $250,000. The FAQs issued in NYC provide that “The Commission on Human Rights accepts and investigates complaints of discrimination filed by members of the public. The Law Enforcement Bureau also initiates its own investigations based on testing, tips, and other sources of information.” That said, the NYC Commission on Human Rights indicated that initially, the focus will be on education and less on penalties.

Resources to help you build a pay scale disclosure strategy

Watch our on-demand webinar with Syndio industry experts Christine Hendrickson, VP of Strategic Initiatives, and Nancy Romanyshyn, Director of Pay Strategy and Partner Success, as they discuss what the New York City pay disclosure law means for organizations and how your team can set up a sustainable foundation for pay transparency.

Then check out our U.S. Pay Scale Transparency Legislation Cheat Sheet to stay up to date on the newest state and city pay transparency legislation and if they apply to your organization.

As these state and city laws continue to gain traction and push for more transparency, leading companies are taking a holistic approach to their pay equity communications strategies. This allows your organization to take control of the narrative and build trust with your employees through transparency. To help you get started, our team has curated real-world examples of how leading companies are tackling pay equity communications in our Pay Equity Communications Lookbook and provided a roadmap to building your own strategy in our Pay Equity Communications Playbook.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. Links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the content on linked pages.