In the world of compensation equity analytics, three things matter a lot: data, methods, and how results are interpreted and implemented. Too often, most or even all of the focus is placed on the data and results. Glossing over which method is being applied might seem okay — after all, aren’t they all mostly the same? And, if you’re not a labor economist or statistician, how will you be able to tell which is the best and most compliant method for your organization?

We are here to tell you that just because a labor economist applies a method, it doesn’t mean that this is the method that you should be applying for your workforce. As I like to say when customers have been using something different before coming onto the Syndio platform, there are no wrong methods; it’s more about finding the most appropriate and optimal method for the specific use case. Pay equity analysis methods vary — and which one you pick can have meaningful real world consequences for the people working at your organization.

For this exercise, we will focus on the use case of running a pay equity analysis to evaluate whether and to what extent the company is paying people differently because of their protected category status (or “PC” status, which can be gender, race, ethnicity, or others), and then forming a remediation strategy that is first and foremost legally compliant but also fair and equitable.

In this article, we’ll explore three primary methodological differences for pay equity analyses and provide you with questions to ask to ensure you’re using the best ones for your organization:

- Using one overall “fixed effect” model versus the group-by-group approach

- Remediating outliers versus remediating underpaid individuals

- Running models including PC data versus running PC-agnostic models

1. Using one overall “fixed effect” model versus the group-by-group approach

In both of these approaches, experts apply a multivariate regression model. A regression model tries to fit a line to the data — data on compensation and factors that drive differences in pay, such as tenure, years of experience, etc. — that predicts how much people are expected to make based on those factors, like we see in the graph below showing the predicted compensation line based on tenure.

Regression models form the basis for figuring out who is owed a remedy by comparing where someone’s compensation would be on the prediction line to where they actually are. In the graph above, Person A is making more than expected or predicted based on their level of tenure, whereas Person B is making less than expected, but not by very much.

Here’s where the choice of methods differ: some experts run one big regression model with all the employees in it and “control for” something like their job title or functional area — this is what is referred to as the “fixed effect.” Other experts opt to run separate models for each group of employees doing comparable or substantially similar work. For instance, one model for engineers and a different model for sales people, and so on.

The former approach can be deployed for small organizations that do not have enough employees for group-level analyses or as a useful tool to bootstrap information for analyzing small groups in larger organizations. It is faster and easier to run for a labor economist or statistician performing the calculations manually. But it is less precise for groups in your organization that are large enough to statistically analyze on their own. It can hide some pay disparities while enlarging others. This means that some people who deserve compensation could be overlooked, or that some people are not recommended pay changes that they deserve. Also, the overall fixed effect model is not commonly relied upon when employers have to defend their pay equity work in court. For example, if a lawsuit alleged that a company is systematically underpaying female engineers, the regression model used to defend the company would most likely use the population of engineers, not the overall population model. Therefore, for companies with enough data (which is most), using individual models is not only more precise, but better mitigates legal risk.

Additionally important, the group-by-group approach allows for tailored modeling of the factors that drive compensation for different groups. For example, educational attainment might need to be included in the regression model explaining differences in pay for a Research and Development group, but would not commonly be included for explaining differences in compensation for Facility Services employees because it is not job-related. Overall fixed effect models would not capture these differences.

When vetting pay equity partners, ask:

- Do you run one, organization-wide regression model, or do you run individual models for each group of employees being analyzed?

- Does your modeling allow for specifying different controls for different groups of employees?

2. Remediating outliers versus remediating underpaid individuals

One approach recommends compensation adjustments to a small subset of individuals who are greater than some number of standard deviations below the prediction line — so called “outliers.” Another approach, the one we recommend, identifies groups with statistically significant pay inequities, and then allows for anyone in the impacted class making less than the model predicts to be eligible for remediation.

The former approach omits some employees for whom there is statistical evidence of systematic underpayment because of their protected class (PC) status and does not ensure that statistically significant gaps are resolved. Not flagging eligible people for a remedy may be unfair and inequitable and lead to serious differences in lifetime earnings. Not making corrections that eliminate the statistically significant differences in the group may mean that even after implementing an outliers-only remediation strategy, the group would remain vulnerable in court.

Some who espouse the outlier-only approach recommend increasing the compensation of all outliers, whether members of the PC or the reference group (e.g. in our example of underpaid female engineers, it would flag both men and women for increases). This would not be an issue for groups not showing any statistical evidence of systematic underpayment because of PC. In fact, it could be a great way to bring people closer in line with expected compensation based on legitimate sources of variation. However, when formulating a remedy for a group with statistical evidence of systematic underpayment because of PC status, recommendations for remediation that include members of both the underpaid protected class and the overpaid reference group can be risky because it may exacerbate existing pay inequities from both compliance and fairness perspectives. If there is statistical evidence that female engineers are underpaid because of their gender, offering male engineers more money could make the gender disparities worse. That’s because when you adjust the pay of the male engineers at the same time as female engineers in this example, you’re moving the goalpost and making it harder to resolve overall disparities for the group. On the other hand, remediating underpaid individuals until the gap is no longer statistically significant ensures that you’ve actually addressed the problem.

When vetting pay equity partners, ask:

- Do you remediate outliers or all underpaid members of the protected class for whom there is statistical evidence of systematic underpayment?

3. PC-inclusive versus PC-agnostic

One approach to building pay equity regression models includes the PC in the model and then nets out the “PC effect” (e.g. the effect of gender or race) when generating remediation estimates. The other excludes the PC(s) from the regression and predicts compensation based on the other factors alone.

The PC-agnostic model assumes that PCs are not impacting decisions by rendering predictions that ignore the impact of the PC and then checks for group-based impact. The PC-inclusive approach directly and more precisely answers the core questions in the pay equity analysis use case at issue. There is a nuanced difference between these two approaches, but it is worth briefly identifying the trade-offs.

The advantages of excluding PCs from the model are that it’s easier, faster, and cheaper for labor economists to run these analyses manually, and some say that it is easier to interpret the results. However, this simplicity comes with a price.

It is unlikely that these approaches would differ in terms of determining whether there is a statistically significant difference in compensation for the PC in question. And, the recommended remediation amounts are close most of the time. However, the main difference is that the PC-agnostic model is likely to miss a small percentage of members of the PC group who are truly underpaid. This is because the differences in the group level residuals used by the PC-agnostic approach are not as precise on the margins as the PC-inclusive approach’s way of netting out the PC effect.

Sound technical? It is. But it’s also fundamentally a more equitable and accurate approach (especially if you ask the handful of people in your organization who would not be flagged for a remedy even though they should have) — and one that is preferred by leading experts on pay equity.

When vetting pay equity partners, ask:

- Do you include or exclude protected categories from your models?

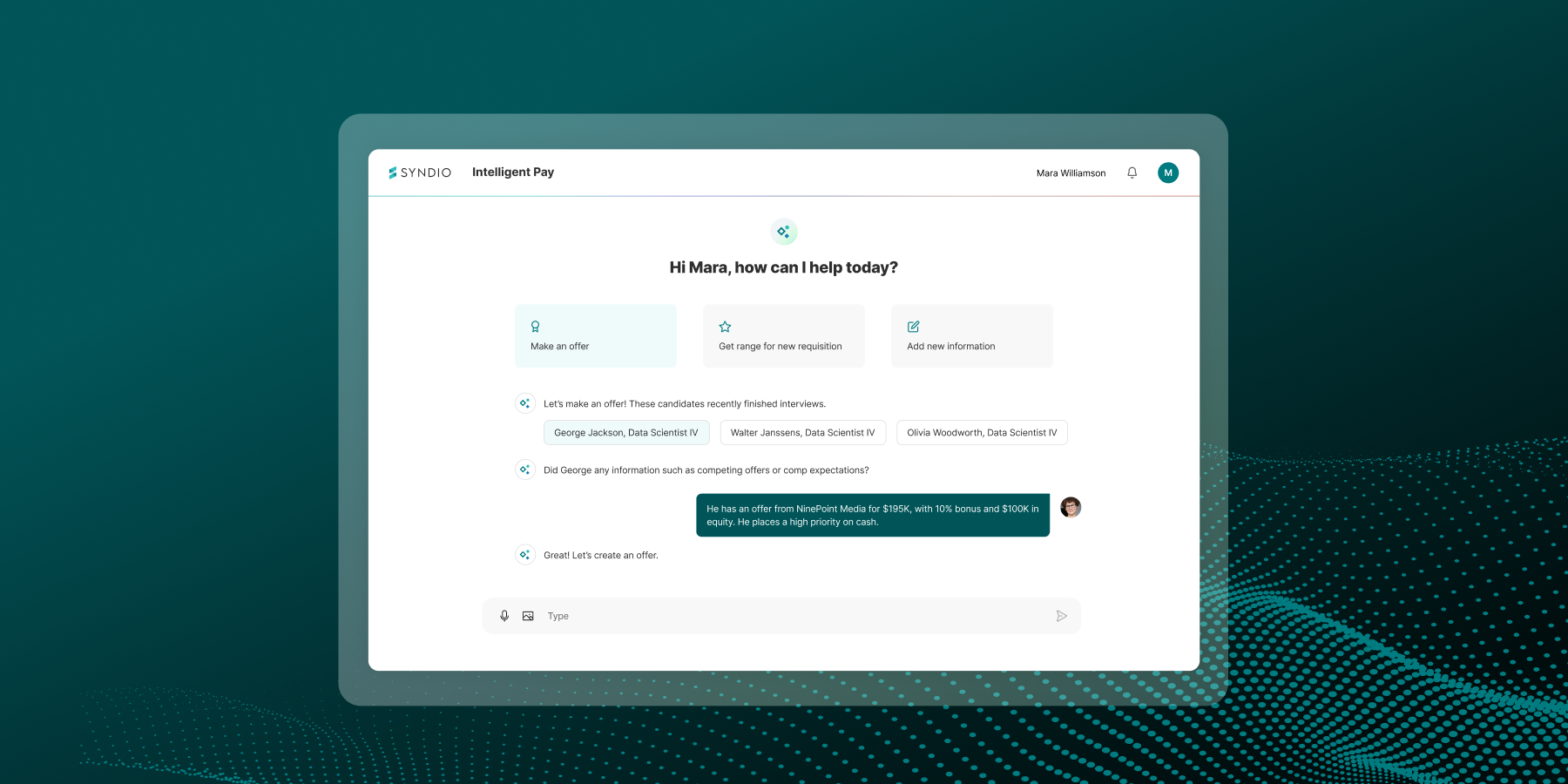

How to apply proven methodologies at scale

While discussions about pay equity analysis methods can feel abstract and esoteric, applied methodologies have tangible consequences for your employees. If left unaddressed, any existing pay inequities and pay gaps can compound over time, contributing to widening disparities in lifetime earnings and wealth accumulation for underrepresented groups. An “okay” pay equity analysis solution is not good enough when substantive employment outcomes such as fair pay are at stake.

Automating pay equity analyses through purpose-built pay equity software enables companies to efficiently apply the most accurate methodologies for their employee population at scale. By partnering with Syndio, companies can leverage the powerful combination of leading pay equity analysis technology and the trusted expertise of data scientists, legal professionals, and compensation specialists to help them strategize, establish, and scale the right pay equity methodology for their organization.

Want to see how Syndio’s pay equity software compares to traditional approaches, such as consultants?

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. Links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the content on linked pages.