Last year’s proxy season was defined by a wave of workplace equity shareholder votes. We tracked outcomes from two types of proposals among the Fortune 100: pay equity or median pay gap disclosure proposals, and broader civil rights audits. While most of these proposals failed at the shareholder vote, several high-profile proposals passed while others received relatively high shareholder support.

New Syndio and NYSE research shows that nearly three quarters of voting shares either will or might support pay equity proposals — and nearly half of shares could swing based on the actions that your firm is taking regarding pay equity at your organization.

We expect the trend from the past few proxy seasons to continue in 2023: more proposals garnering more support from investors. We partnered with NYSE to investigate how investors approached these proposals last year. We find that half of potential voting shares swung from support or opposition of these proposals, explaining the wide swing of outcomes from 19% to 60% of shares supporting increased pay equity disclosures at different firms.

In this post, we’ll review which major investors overwhelmingly supported pay equity proposals, which tended to oppose them, and which were split depending on the proposal. We’ll also discuss what this means in the context of sustained activist shareholder pressure, and how you can prepare if and when these proposals come for you.

How did major investors vote?

Our analysis includes the votes of the largest asset managers who voted on at least one of the seven pay equity proposals among the Fortune 100 we tracked in 2022. Data were provided by S&P Global and NYSE, and is sourced from SEC filings. Each publicly traded company’s mix of shareholders varies, so the breakdown of how your shareholders would vote will vary from this sample. Additionally, not all investors are required to disclose how they voted, representing an unknown batch of shares. This includes some large managers (like Berkshire Hathaway) and a long tail of smaller institutions.

We categorized institutions into three buckets: those who consistently voted in favor of pay equity proposals (siding against management), those who consistently voted against pay equity proposals (siding with management), and those whose votes varied across the seven proposals.

First, we analyzed how equity assets under management (EAUM) fall into these three categories. For this analysis, we limited to institutions with more than $200B in EAUM and their global subsidiaries managing at least $25B. This covers a large proportion of total shares. On average, institutions in this analysis voted on 6.5 of the 7 pay equity proposals under consideration.

When we break the support down by equity assets under management, we see that across-the-board or conditional support of pay equity proposals covers nearly three quarters of voting shares — 21% of voting shares supported all pay equity proposals, 50% swung from support to opposition on a case-by-case basis, and 29% defaulted to siding with management. Nearly half of assets represented here sided either with or against management on a case-by-case basis. Lowering the threshold for inclusion for institutions with data available in SEC filings shows slightly more outright or conditional support for pay equity proposals, increasing from 71% to 74% when we decrease the threshold from $200B to $50B. We prefer the higher threshold as coverage becomes less complete when we include smaller investors.

We also break down the support or opposition by specific asset managers. Three of the five asset managers with over one trillion in EAUM determined their support on a case-by-case basis, while The Vanguard Group sided with management and Capital Group Companies supported pay equity proposals. Note that in our sample we found only eight asset managers who opposed all seven pay equity proposals.

What you should take away from this analysis is that the majority of shares will or could support a pay equity proposal at your organization. Half of asset managers (weighted by EAUM) took a true case-by-case approach, supporting some proposals and opposing others. This means these shares could swing based on asset managers’ assessment of your pay equity program.

What can you do to prepare to engage with shareholders?

The wave of pay equity shareholder proposals is far from over. Activist investors continue to push these proposals, and legislation related to pay equity continues to spread to more and more jurisdictions. Below are three things you can do now to avoid having a shareholder proposal determine how and when you discuss pay equity at your organization.

“Knowing who your major shareholders are, the decision-makers at each, and how they make proxy voting decisions are important best practices for all public companies.” said Brian Matt, Director & Head of ESG Advisory at New York Stock Exchange. “In the case of pay equity shareholder proposals, you’ll likely see a large portion of the institutional community open to voting in either direction; to us this is a signal that investors are available for engagement and discussion on how the company approaches pay equity. Whether or not they face a shareholder proposal, we believe companies should find a willing audience at many large investors for telling their story about how they are analyzing and addressing workplace equity.”

The signal we are getting from asset managers is that they take into account a company’s current policies or efforts, their current disclosures relative to a peer set, and whether there have been any legal, regulatory, or controversial actions related to pay equity at the firm. An effective pay equity program is the key to any investor relations strategy around these proposals.

1. Ensure you have addressed pay equity issues

First and foremost, you want to make sure that your firm is not the target of a pay equity class action lawsuit. Obviously, this is not entirely in your control and something you would never choose. However, taking proactive steps to identify and address potential gender- or race-based pay discrepancies among employees performing similar work at your organization can reduce the likelihood of these lawsuits coming to you.

“Litigation is costly for everyone involved. One of the driving motivations behind our push for pay transparency is to reduce and ideally eliminate the need for employees to bring pay equity litigation by creating the conditions and incentives to drive employers to set pay more equitably and to hold themselves accountable. The shift towards more transparent models will inevitably unearth problematic disparities; and we recognize employers will need some time to clean house and correct them.”

– Seher Khawaja, Senior Attorney for Economic Empowerment at Legal Momentum

The first step in preparing for a future proposal is following established best practices to identify and address any pay equity issues.

2. Build your communications plan

When investors are evaluating whether or not to support a pay equity proposal, they will review what the organization has said about their pay policies and what they have disclosed publicly. A thoughtful communications strategy will enable you to articulate to investors that your pay equity program is already moving forward at a deliberate pace, and that a shareholder proposal is not necessary. Saying nothing on this front makes it more likely that a proposal will dictate how and what you must disclose around key statistics.

We have seen a growing number of organizations of all sizes decide to disclose their unadjusted median pay gaps without the mandate of a passed shareholder proposal. In some of these cases, the agreement to disclose resulted in withdrawn shareholder proposals. Other organizations made proactive disclosures without specific pressure from shareholders.

We put together a workplace equity communications playbook that will help you develop a communications strategy that gets the job done for your company, your investors and — most importantly — your employees.

3. Benchmark against your peers

Finally, asset managers are not looking at your policies, programs, and disclosures in a vacuum. They consider what your industry peers are doing. Being a leader in pay equity among your peer set of comparable companies — or at least not being a laggard — makes it more likely for asset managers to side with management. We compiled a workplace equity communications lookbook of the various approaches organizations are taking that can help you make an informed decision about the right approach for you.

That said, all industries are trending towards more transparency when it comes to workplace equity. A position in the middle of the pack today may well be lagging behind in three years.

Build your pay equity program now to mitigate future shareholder action

The best way to prepare for potential shareholder action around pay equity is to develop a robust pay equity program now. This should include an analysis that follows best practices and established case law, a deep understanding of key outcomes and any problem areas, a commitment to address any residual pay equity gaps through targeted remediation, and a deliberate communications strategy. With this program in place, you will have all the pieces you need to engage with investors around potential pay equity shareholder proposals.

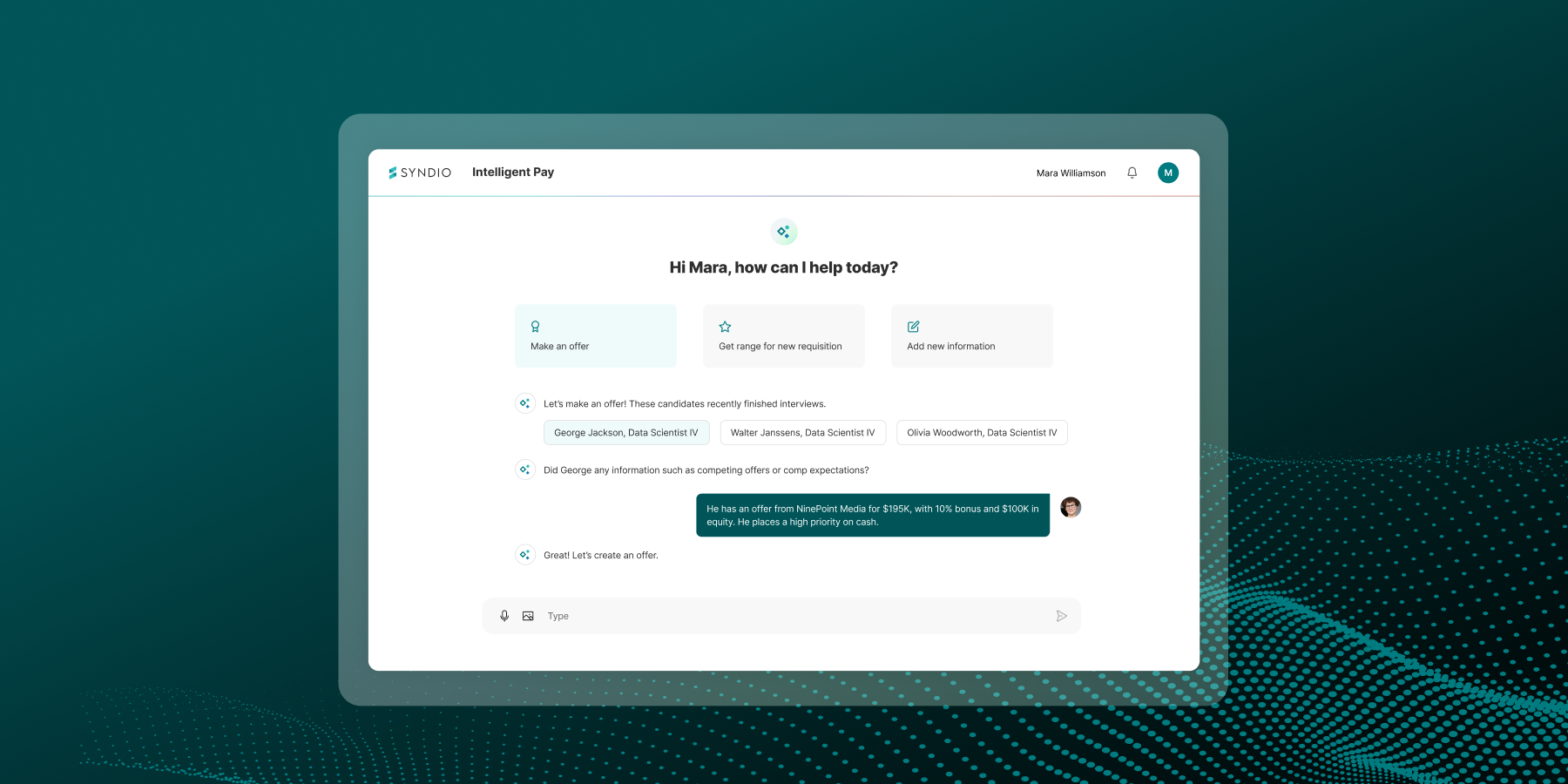

Want to learn how Syndio’s platform helps you answer not just what pay disparities you have, but why you have them?

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.