The belief that sunlight is the best disinfectant has led to a push for more transparency and disclosures around internal pay gaps within U.S. employers. On job postings and required filings, a new wave of legislation requires companies to report more and more statistics related to pay by race and gender within their organization.

Last week, California’s Department of Fair Employment and Housing (DFEH) released aggregate pay data they collected for the 2020 year. The California pay report is well worth paying attention to: this is an unparalleled data set showing detailed insights on the pay of employees from the most populous state in the U.S., representing the world’s 5th largest economy.

This also matters because employers may be called to release their own data, which can then be compared – potentially unfavorably – against this aggregated dataset or other employers. California has a proposed bill that would require employers to release this data publicly. Even absent a disclosure requirement, employers may expect activist groups to pressure them to release these forms in the future, just as they have done for years around the federal EEO-1 form.

However, employers may not find sunlight around California’s current pay data report illuminating. The current California pay reports reflect several overlapping potential root causes. Some of these dynamics are within a company’s control and potentially unlawful (e.g. unequal pay for similar work), while others will reflect broader labor market trends in their industry. How should companies interpret this information and respond to disclosure requests?

The data show extensive pay gaps, particularly for Black and Latina women

The California pay report requires employers that have at least 100 employees (inside and outside of California), that are required to file an EEO-1 report, and that have at least one employee in California to report compensation data by EEO-1 job categories by gender, race and ethnicity to the DFEH every year. The aggregate data recently released by the DFEH reflects the first year of data collected (based on calendar year 2020 data). In addition to identifying the job category, race, ethnicity, and sex of each of its employees, employers assign those employees to the appropriate pay bands within each job category. A sample of the report is available here.

The first and most striking observation about the data is that women, and particularly women of color, are disproportionately in the lower-earning pay bands. For example, the majority of employees in pay bands earning less than $30,679/year were women (55% women and 45% men). Meanwhile, men outnumber women in the top pay bands nearly two to one. For those earning $128,960 or more, 36% were women and 64% were men.

These gaps were particularly pronounced for Black women and Latinas. Take this illustration showing the gaps for Black women, Latinas, and white men:

Black women and Latinas are much more likely to be in that lowest pay band: 37% of Black women and 39% of Latinas in the data received less than $19,239 from their employers in 2020. Only 17% of white men earned less than that amount. (At 17%, Asian men are the only group less likely than white men to fall in that lowest pay band.)

Companies’ individual reports may look very different from these aggregates. When reviewing their data internally, how should companies identify what factors are driving their results?

First things first: resolve unlawful pay discrepancies

First, know thyself. Employers should start with a pay equity review to see if the gaps they are seeing within their own workforces reflect differences in pay rates between employees performing substantially similar work after taking into account experience and other legitimate factors. Addressing unexplainable pay differences within similarly situated employee groups is both urgent and relatively straightforward.

California pay data show an income gap vs. a pay gap

Once companies have a handle on their data, they should identify the underlying trends that are driving their results. This is not to explain away the gaps but to understand the way that the numbers reflect many different trends — employers need to unpack those trends so they can make progress to close the gaps.

The first trend to know is that because DFEH collects Box 5 of the W-2 data, what we see here is an income gap and not a pay gap.

The data show total earnings from a single employer, so earnings for part-time and part-year workers (especially in relatively lower earning jobs) will fall into the lowest earnings bucket, under roughly $19,000 per year. Imagine this scenario: you are a fast food retailer. You have cashiers who earn the equivalent of $11.00/hour on their W-2 wages. For the cashiers who worked a full year, their pay would be captured and reported in the $19,240-$24,439 pay band. However, those cashiers who also earned the equivalent of $11.00 but did not work a full year – for example, only worked six months of the year – would be reported in the $19,239 and under pay band because their W-2 earnings reflect only a partial year of work.

In the aggregate, these differences will also be impacted by industrial segregation. Low pay band jobs represent 61% of Accommodation and Food Services (where women of color disproportionately find themselves), and 12% of Professional, Scientific and Technical Services.

If a company sees a large proportion of employees in the lowest pay band, they should examine the demographics of employees in low paying, high turnover jobs, and ask how they can improve the experience in those jobs and the long-term career prospects of the workers who currently occupy them. In terms of supporting metrics, companies should review retention and promotion rates within job levels by race, gender, and their intersections, particularly in entry-level positions.

Identifying controllable pay gap factors

The second thing we can see in these data is the shape of the earnings distribution. Outside of the lowest earnings bucket, Black women are most likely to fall into the $39-$49.9k pay band (9% of workers), and Latinas are most likely to earn in the $30.7-$39k pay band (12% of workers). The most likely pay band for white men is the top band (over $208k) by a long shot, representing 17% of white male workers.

My colleague recently detailed four root causes of pay gaps, which also drive the differences between these distributions: pay inequity, opportunity inequity, pay differentials between job functions, and employee-driven factors (e.g. certain communities being more likely to take part-time work).

The first two factors are within a company’s control. Companies can identify issues by conducting pay equity analyses, analyzing hiring and promotion rates by race and gender, and setting reasonable goals to increase representation of under-represented communities in management, leadership, and other high-paying positions. These analyses may spur programmatic changes at a company, such as targeted mentorship or up-skilling programs.

Owning the narrative through proactive transparency

Because the DFEH filings do not point to a single issue, companies will find these data alone of limited use. However, the filing’s uniformity and intersectionality are appealing to folks who want to understand how companies stack up against one another in terms of the pay gap and opportunity equity, so we anticipate that calls to disclose these forms will gain steam in the coming years.

To prepare for potential disclosure in the future, companies should start the hard work today by proactively identifying and addressing any race- or gender-based drivers of differential pay or employment outcomes.

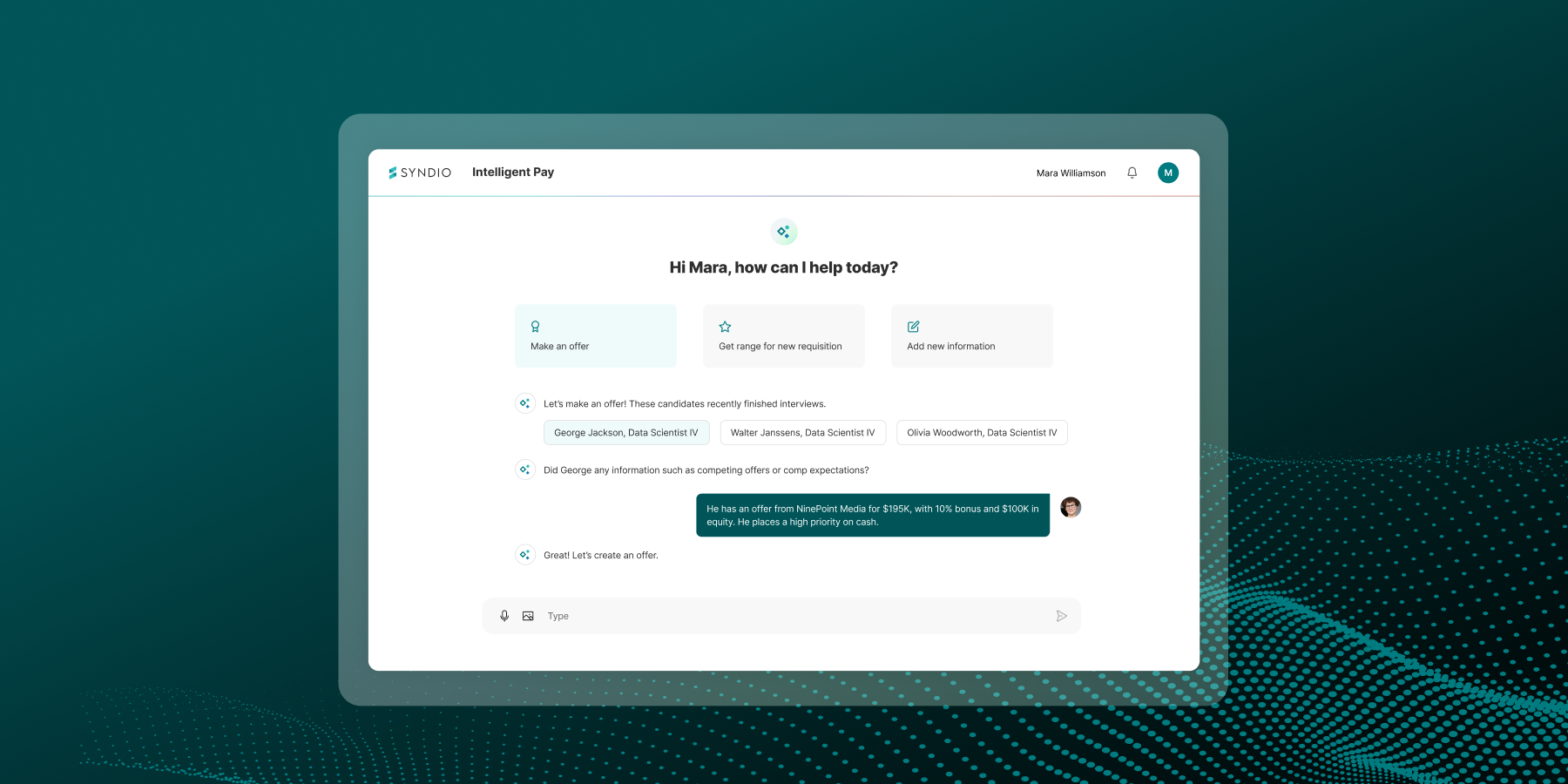

Transparency will be a key part of this process, and companies should start thinking now about what metrics they want to disclose to tell their story on their terms. While there’s a spectrum to transparency, forward-thinking companies will start taking steps now to disclose metrics like median pay gap or salary ranges. This will build trust with employees and help employers own their pay and workplace equity narrative.