What are the crucial factors that relate to pay equity in an airtight analysis? Below, we walk you through the steps for how to do a pay equity analysis and offer some of our best prevention and maintenance tips.

What is a pay equity analysis?

When you analyze pay equity, you compare the pay of individuals in two groups of people who are doing substantially similar work to see if there’s a statistically significant difference in pay that can be found between protected classes (like gender or race).

Said in plain English: you’ll look to see if one gender or race is paid less than the other for doing pretty much the same work.

For example, you may compare compensation for female sales reps with male sales reps. Or among all of your sales reps, you may compare compensation for employees of color with white employees.

How to do a pay equity analysis: Find, fix, and prevent issues

You know what you want to work towards fair pay for all employees, but where do you start and what are the factors that relate to pay equity? How do you conduct a pay equity analysis? Who should be involved in the process? Here are some key takeaways, and be sure to download the guide for more detail.

1. Engage internal stakeholders

Pay equity is a commitment — and potentially sensitive. Ensure your senior leaders are on board and aligned on the organization’s pay equity plan and expectations. It’s also important to enlist support from your legal, compensation, and Diversity & Inclusion (DE&I) teams, who will play an important role in helping you execute short- and long-term goals.

2. Group employees doing substantially similar work

Pay equity is about equal pay for equal work, or more specifically: “comparable” or “substantially similar” work. To create groups of employees doing substantially similar work, consider skill, effort, responsibility, and working conditions.

For example, graphic designers, writers, and marketing analysts are all part of the marketing team and the roles require similar effort, responsibility, and work conditions. However, their skills are different, so they don’t all belong in the same group.

On the other hand, sales analysts, business analysts, and marketing analysts are on different teams and have different titles, but their roles are similar in effort, responsibility, working conditions and skills. Therefore it’s reasonable to group them together.

3. Control for job-related factors

Once you set your groupings, apply controls. A control is a compensable factor that can be used to justify differences in pay, even for individuals doing the same job.

A simple way to think about it is that groupings focus on which employees should be compared to each other; controls focus on what’s different about those employees that would explain why some people are paid more than others.

Understand that you can’t use controls for any old reason. According to regulations, they must be objective, job-related factors that directly measure characteristics of an employee or their role, and that you’d use to differentiate pay. This may include hire date (seniority/tenure), location (city, state, facility), educational attainment, manager-status, and years of relevant experience.

4. Identify and review protected classes

Pay equity laws at the federal and state levels don’t merely protect one race, one gender, or certain ethnicities. The laws require that employees are paid without regard to these protected classes, which means that, with a few exceptions, employees don’t have to be in a historically disadvantaged group to bring forth a lawsuit.

Work with your legal counsel to determine which protected categories you want to analyze.

5. Make adjustments before allocating budget

If you misclassify employees or don’t fully capture pay practices with your initial controls, you may be able to clean up and correct data in order to reach resolution without paying employees more via remediation.

Iterate on these steps to make sure you’re starting from an accurate baseline. When you work to group people together accurately and use the right controls it will be easier to make adjustments and account for business changes (e.g. mergers, acquisitions) on an ongoing basis.

Using pay equity analysis software to automate the process further accelerates the process, allowing you to quickly make changes to sustain your pay equity.

6. Take action on your pay equity results

Once you complete your pay equity analysis, work with HR and the Compensation team to remediate salaries. And be transparent — with leadership, employees and even the public.

When you communicate effectively about your pay equity actions, it has the power to boost retention, performance, and workplace satisfaction; and it evens enhances your brand with customers and prospective candidates

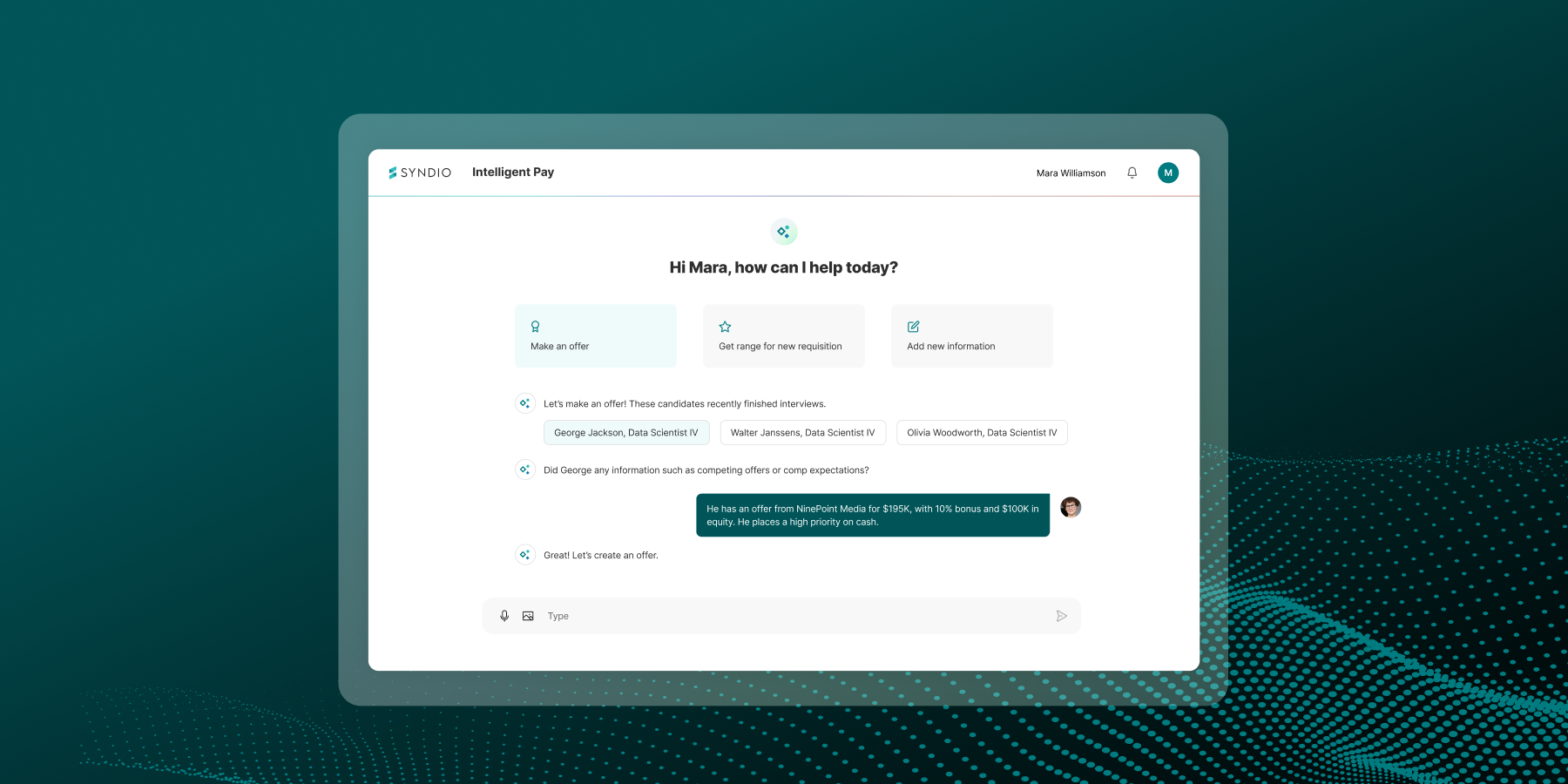

Bonus step: Prevent and maintain

Who says pay equity only happens once a year? Leading brands use always-on software to assess and address pay equity — any time they need to. Mid-year comp cycles, lay-offs, and M&A are all important events that trigger companies to take another look at pay equity.

The longer pay inequity sticks around, the wider the gaps tend to grow and the more costly they are to resolve. That’s why the most advanced brands assess pay equity two to four times a year, even without any triggers. With this approach, they significantly decrease time out of compliance and lower overall remediation fees.

True pay equity is the right choice — for your employees, for your brand, and for your business. Download the guide to learn more about how to do a pay equity analysis.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.