Pay Gap Reporting Hub:

Comprehensive guides for global compliance

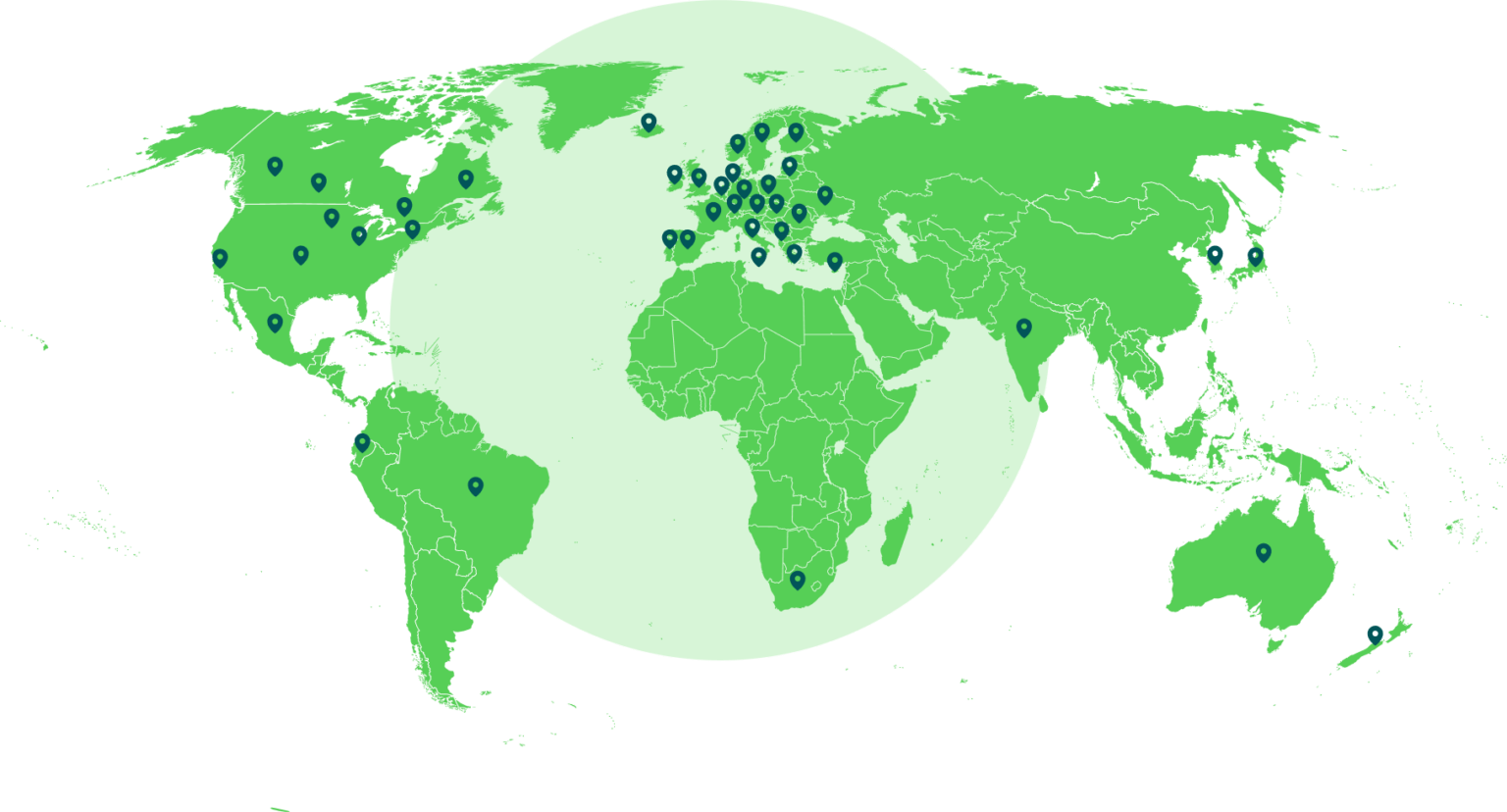

Navigate the complexities of international pay gap reporting with comprehensive guidance on regulations across 43 countries and 35 jurisdictions. Gain clarity on critical deadlines, qualifying thresholds, and required metrics for accurate and timely reporting. Stay on top of the EU Pay Transparency Directive and its impact on future requirements.

Stay informed: Key updates and deadlines

DEADLINE APPROACHING

Australia

Australia's Workplace Gender Equality Act 2012 mandates that non-public sector employees with 100 or more employees submit…

NEW DRAFT LAW

Sweden

Sweden's Discrimination Act of 2008 requires employers with 10 or more employees to prepare an annual report on…

DEADLINE APPROACHING

California

Employers covered by California's Pay Data Reporting law must submit annual reports that include pay, demographic, and other workforce data…

Overwhelmed by requirements? We can help.

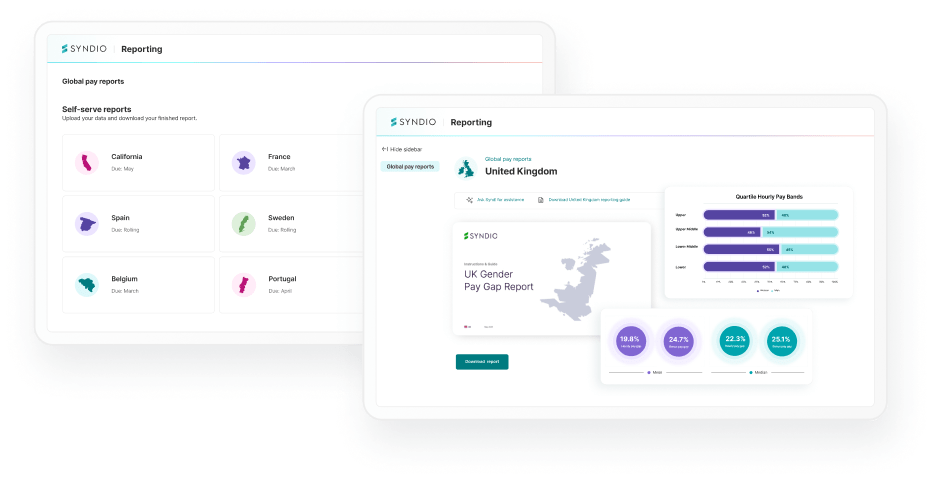

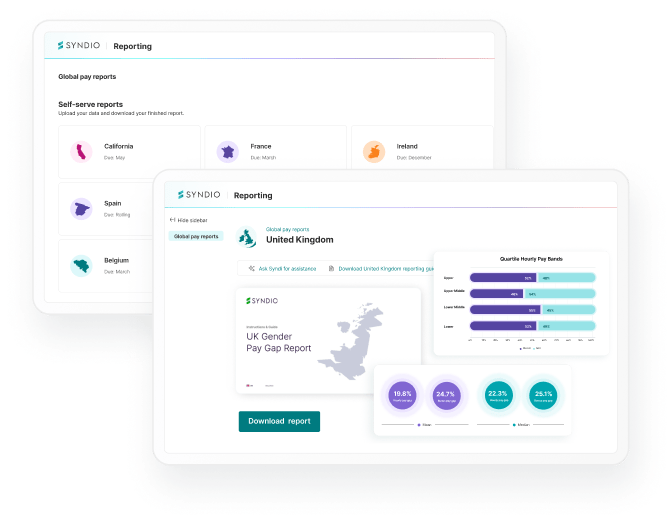

Syndio's Global Pay Reports software helps you centralize and streamline pay gap reporting in 35 jurisdictions. Never miss a report. Complete reports faster. Comply with confidence.

Top pay reporting resources

Global Pay Data Reporting Calculator

Find out where your company must report pay gap data around the world.

EU Pay Transparency Directive Playbook

Learn what's required to comply and how Syndio can help.