On-demand pay audits — powered by the #1 technology solution

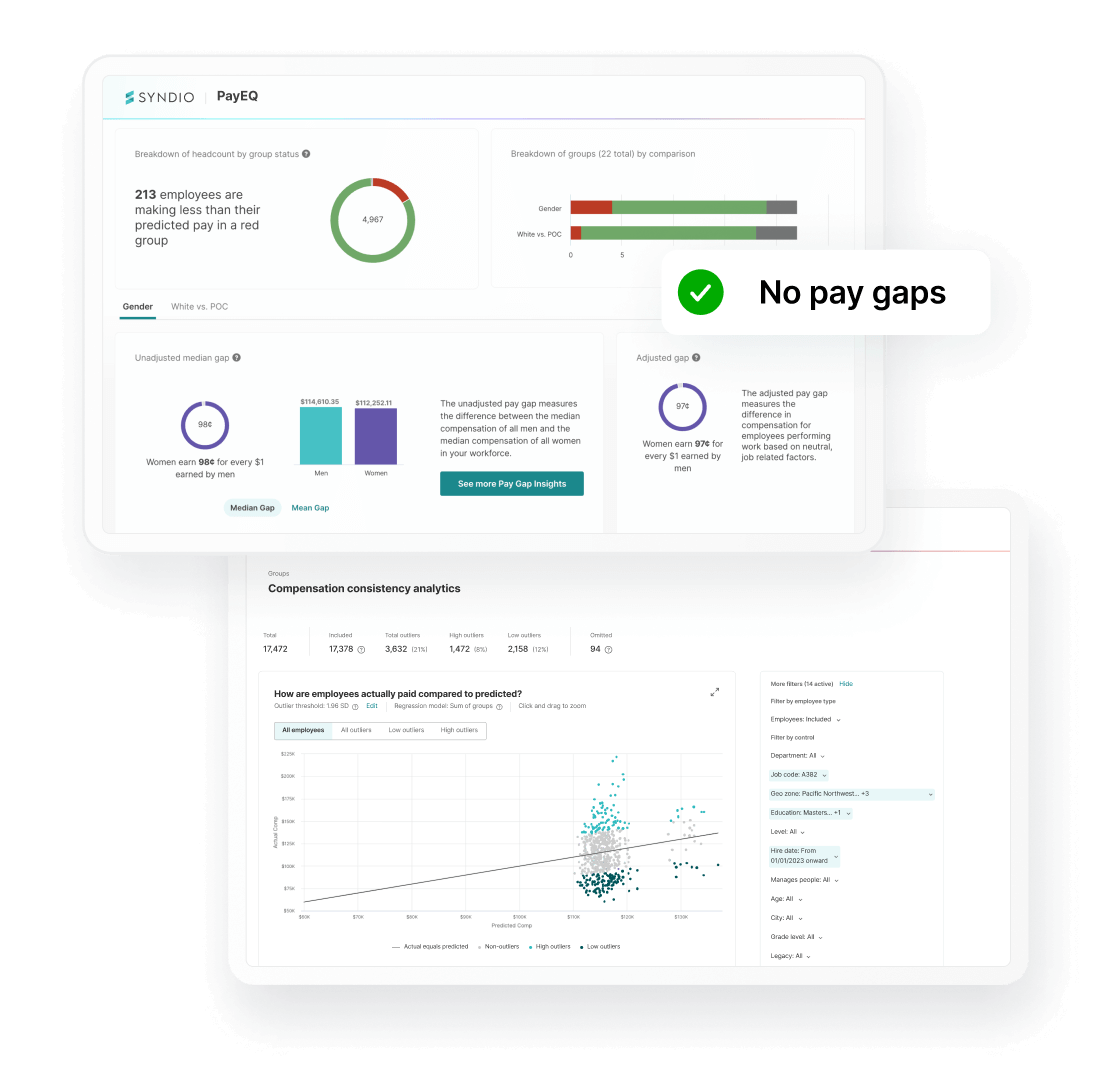

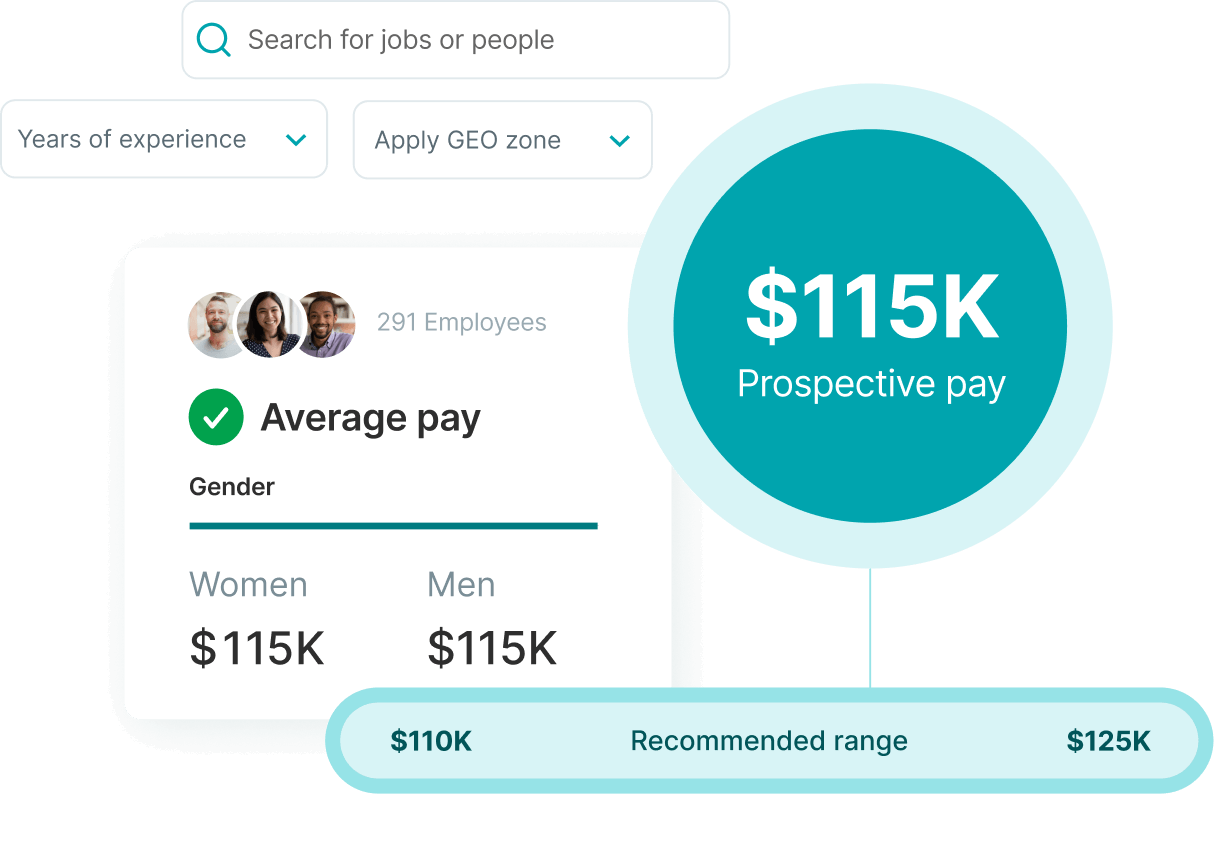

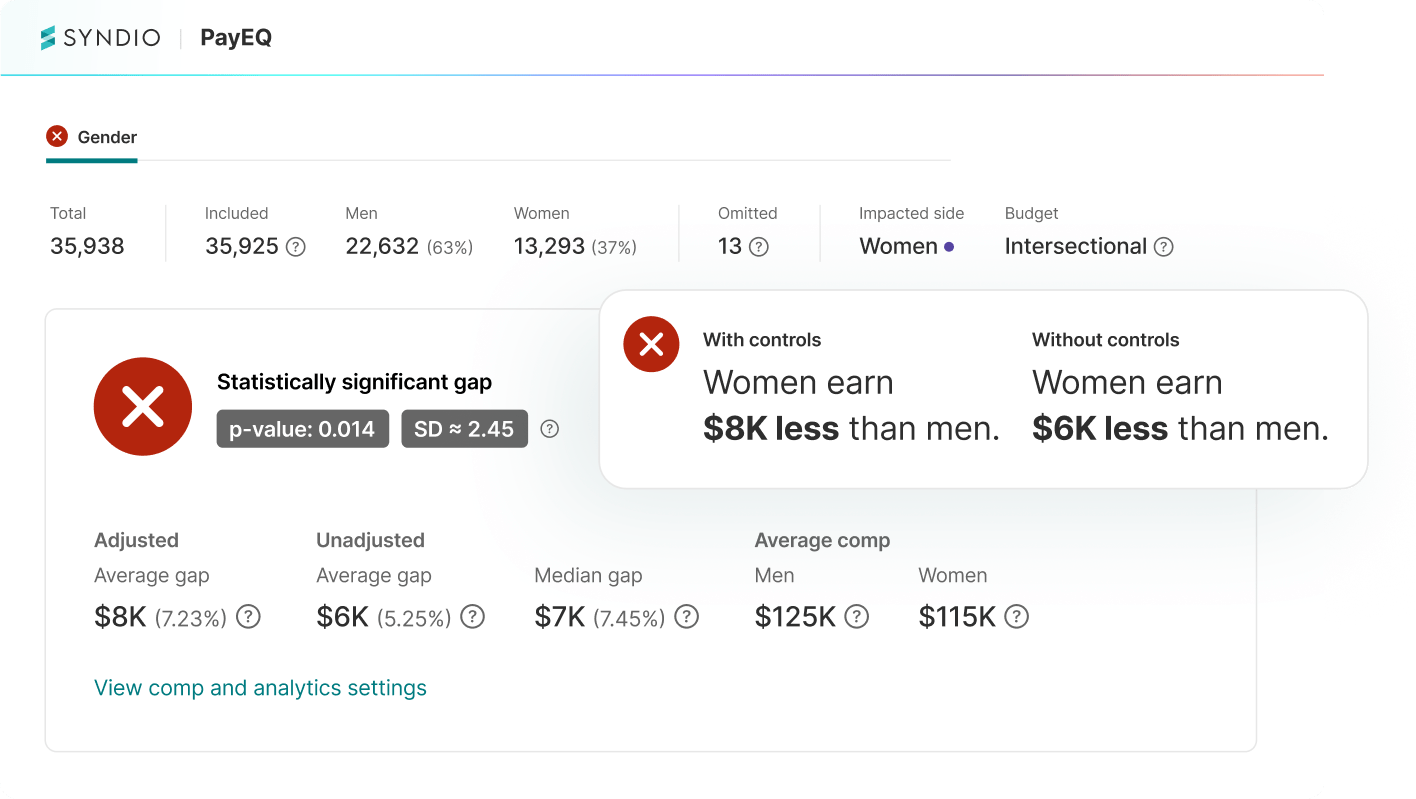

Find and fix unlawful pay disparities and ensure fair, consistent, and explainable pay. Built by experts, PayEQ gives you visibility into your data, helping you understand inconsistencies and take informed action — quickly, sustainably, and at scale.

Reduce time spent finding unlawful pay inconsistencies

Cut costs by eliminating manual work and costly consultants

Build trust and confidence with clarity on your data and analysis

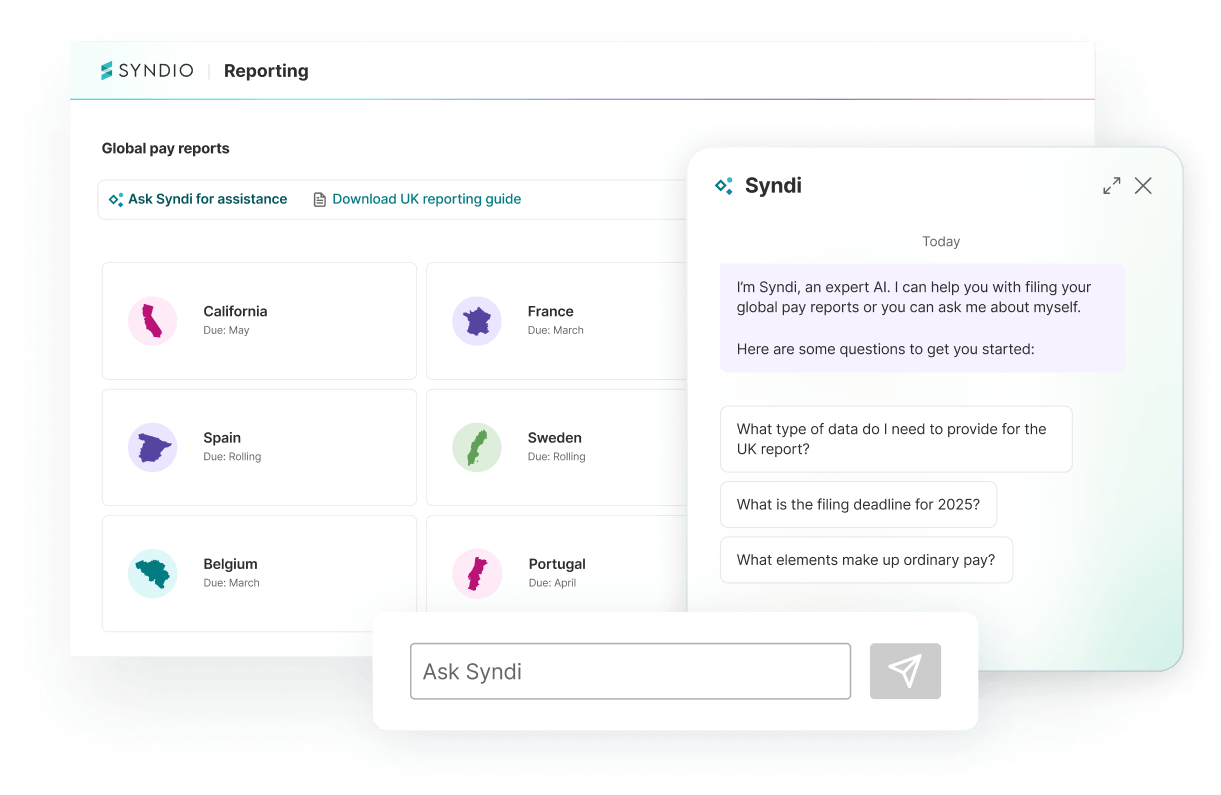

Stay compliant with U.S. and EU regulations in one platform

Prevent future gaps by uncovering root causes

Build trust and confidence with clarity on your data and analysis

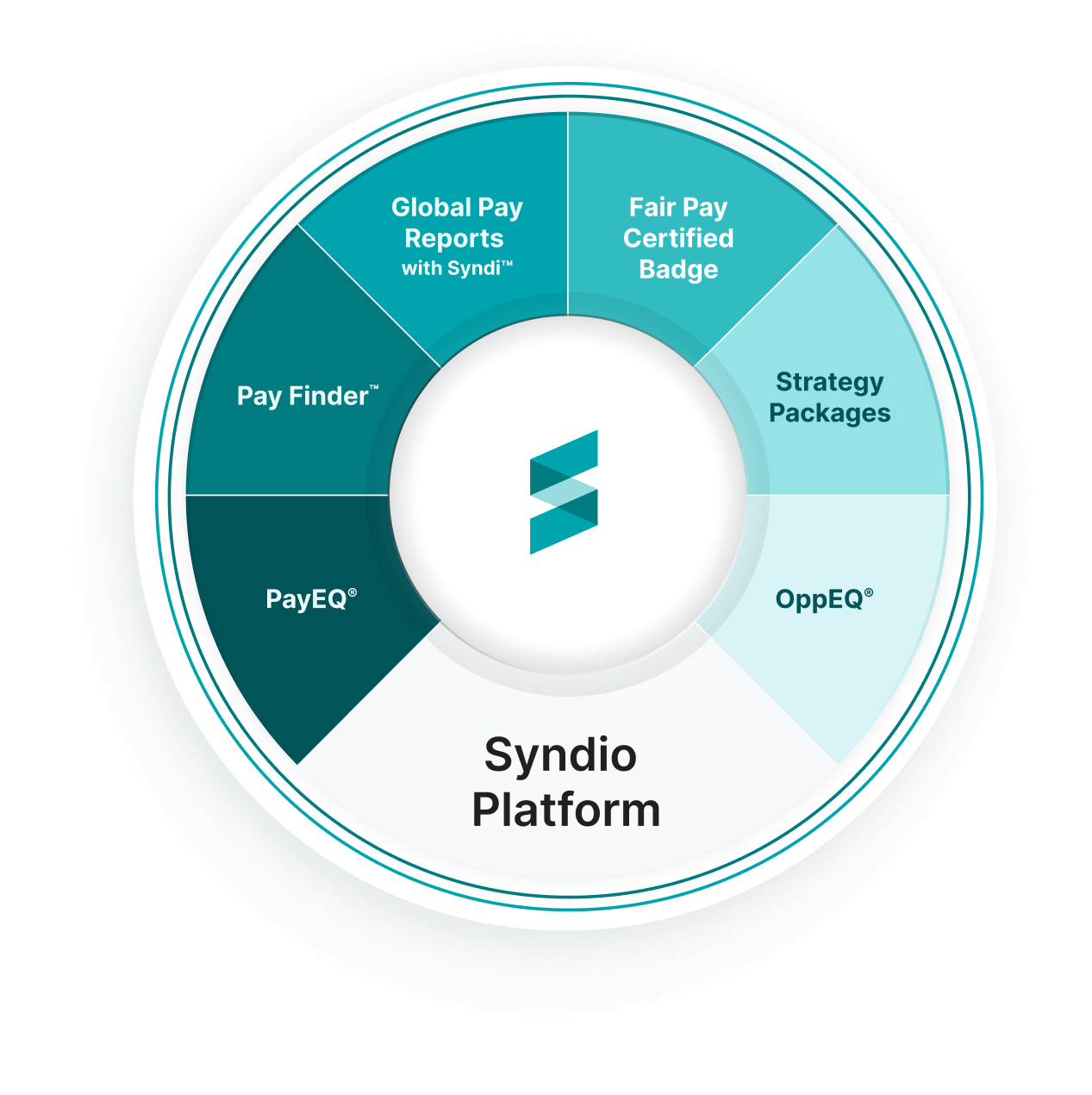

The complete solution for fair pay

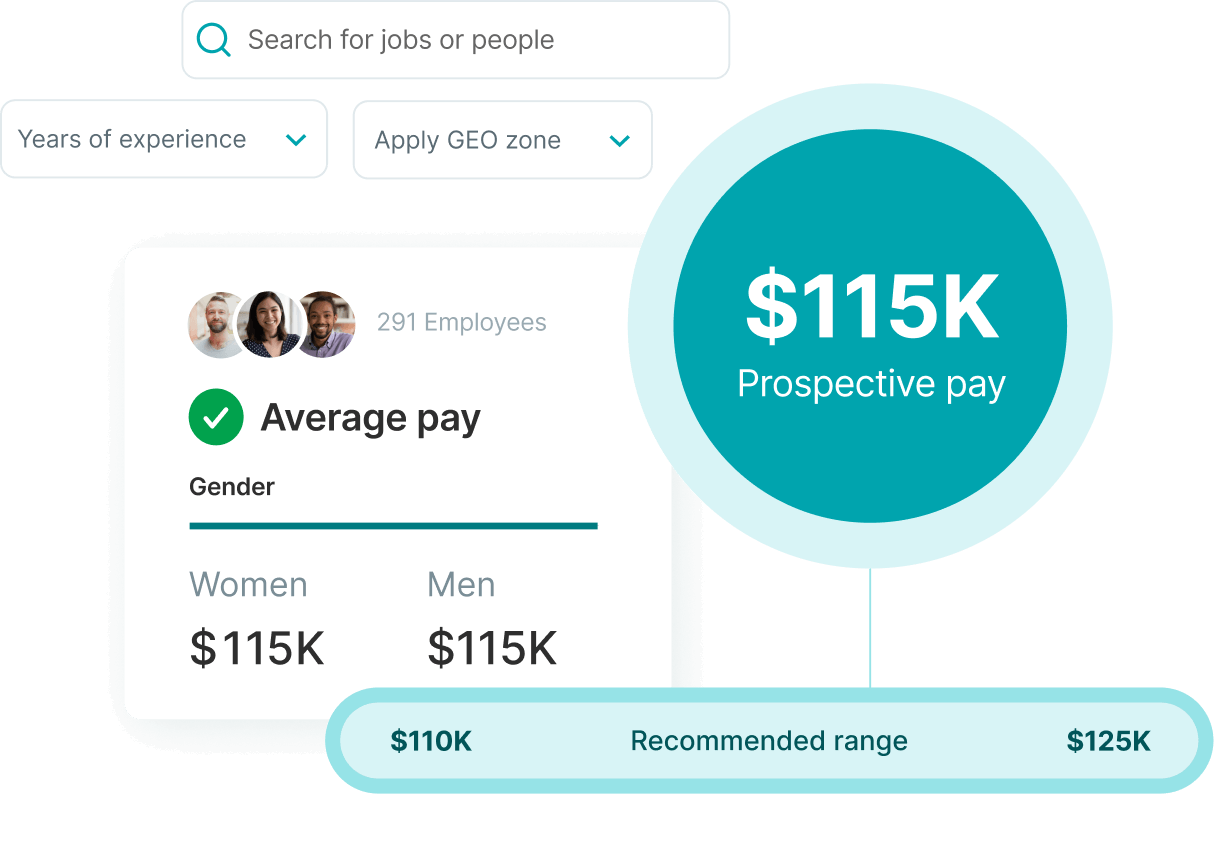

Calculate precise pay adjustments

Calculate precise pay adjustmentsInstantly calculate budgets to address pay disparities, then share detailed reports.

Stay on track

Stay on trackAudit pay at any time to catch and prevent new issues.

Top features

Legally defensible pay audits

Ensure legal compliance with unique regressions for every employee group and use highest paid reference groups to deliver accurate results.

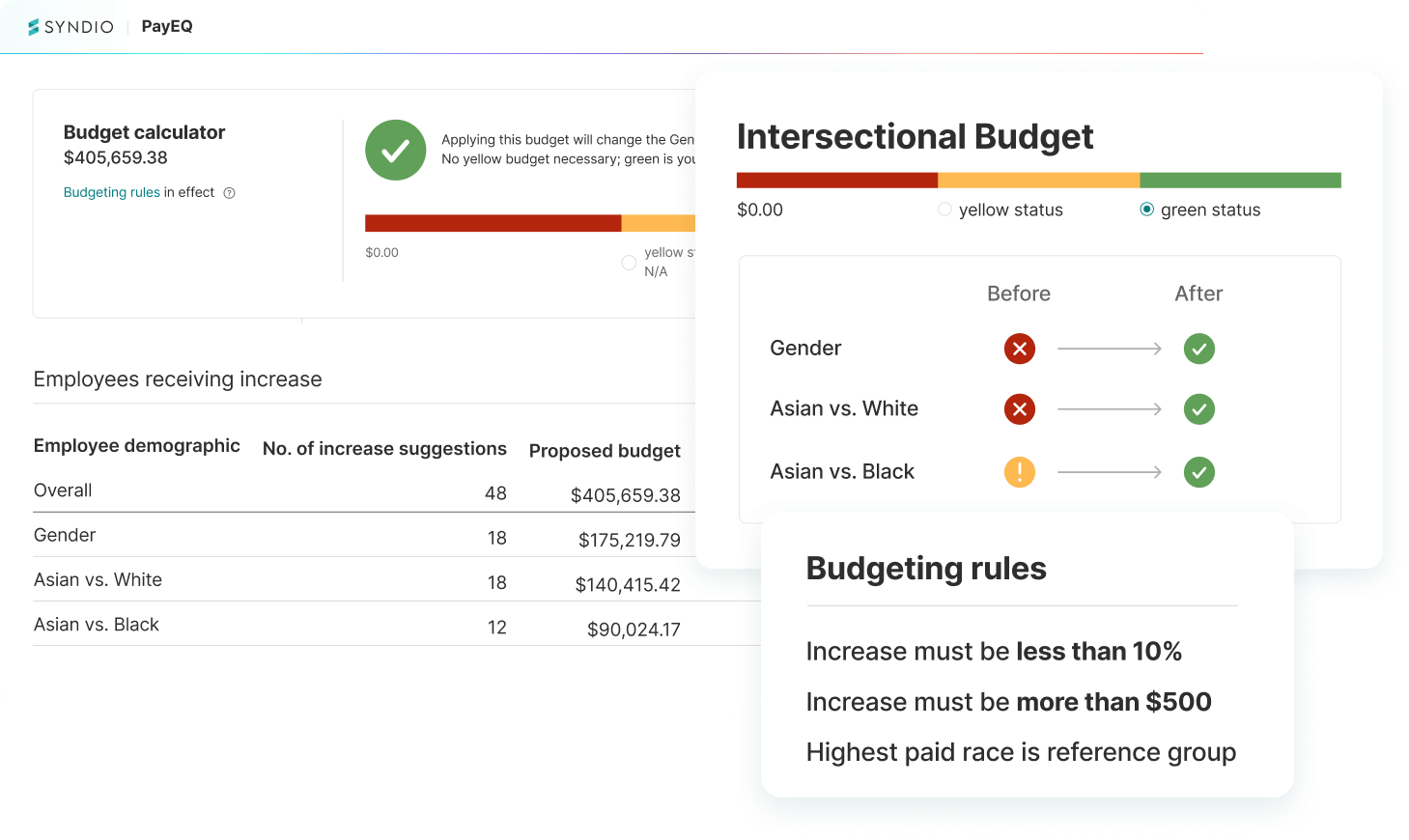

Smart, cost-effective budgeting

Instantly test 100s of options for the most cost-efficient pay adjustments, including intersections.

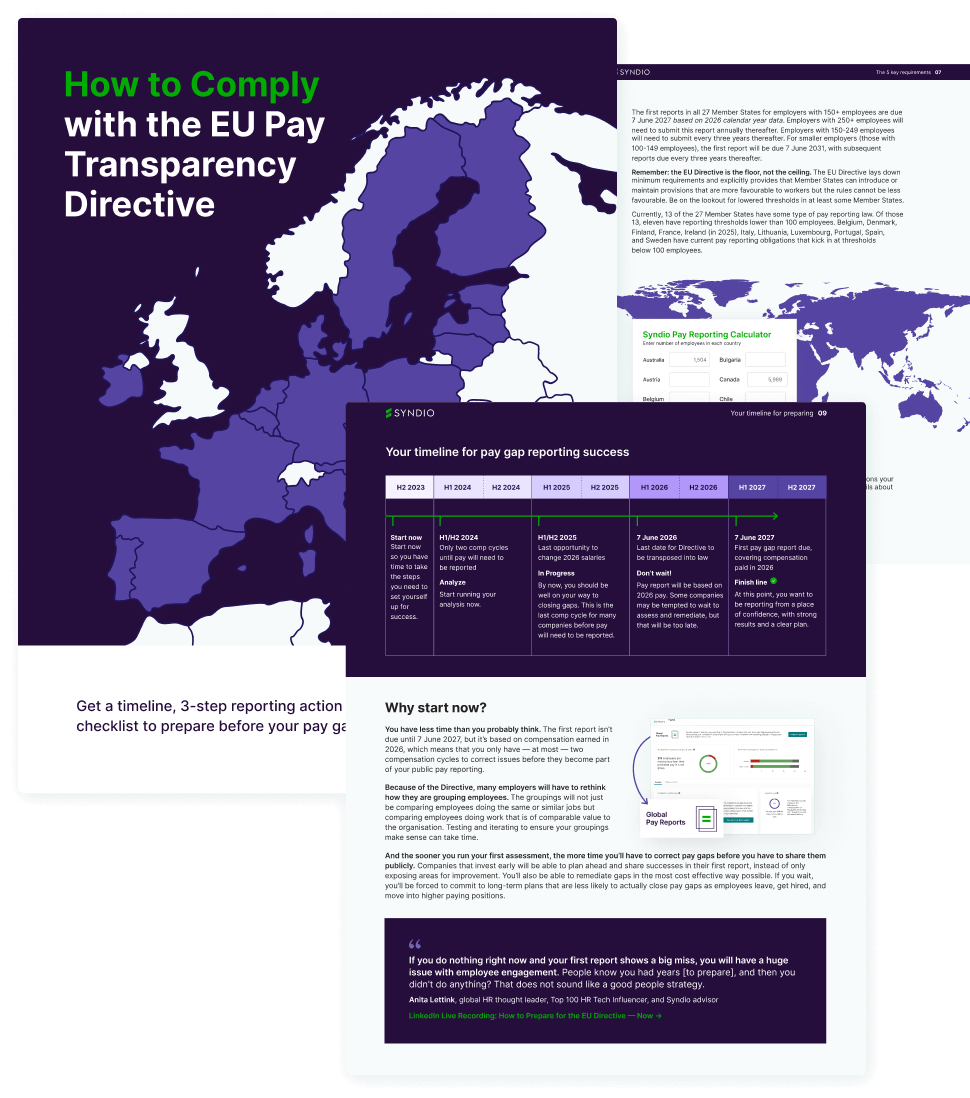

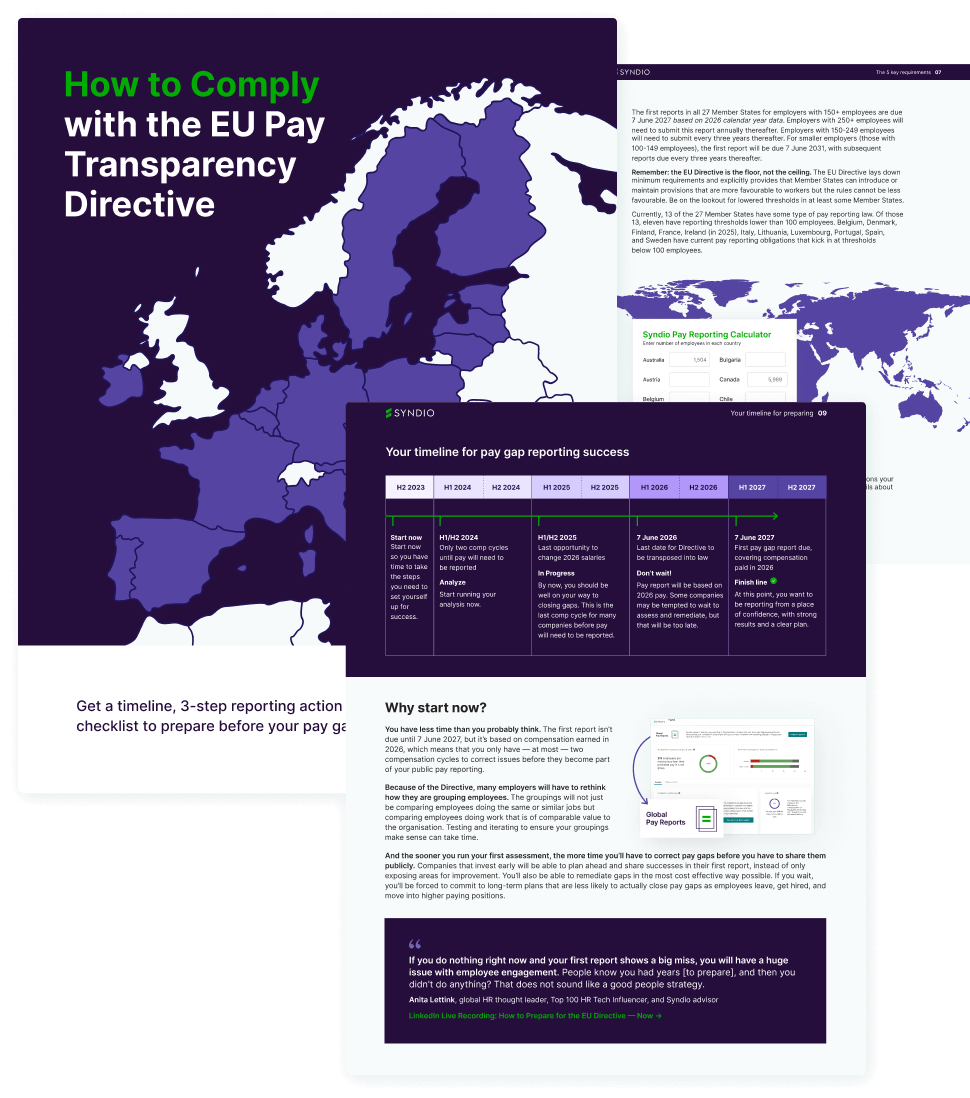

EU Pay Transparency Directive compliance

Check all EU compliance boxes — group employees doing equal value work, close gaps greater than 5%, and comply with employee “right to information”.

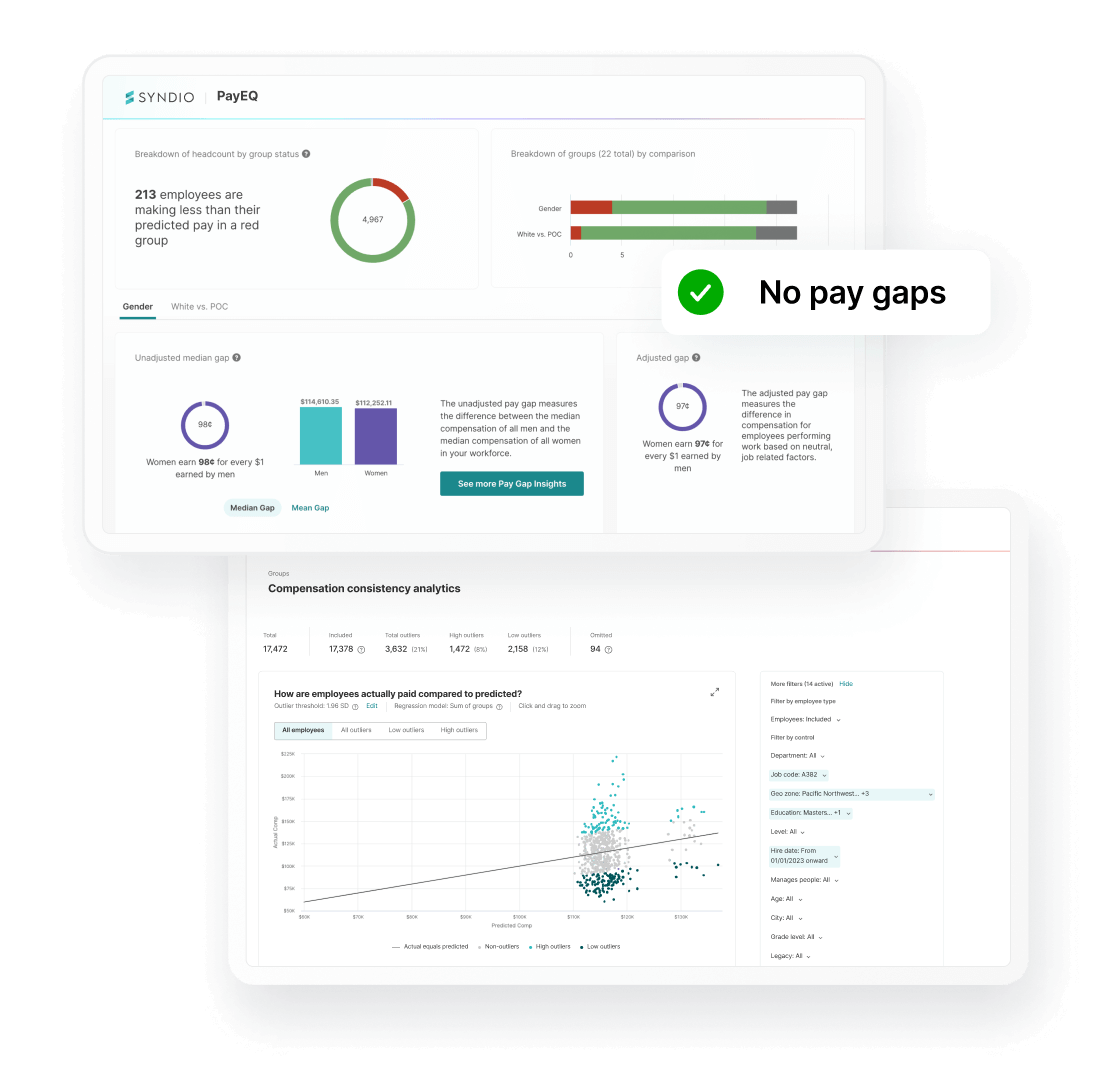

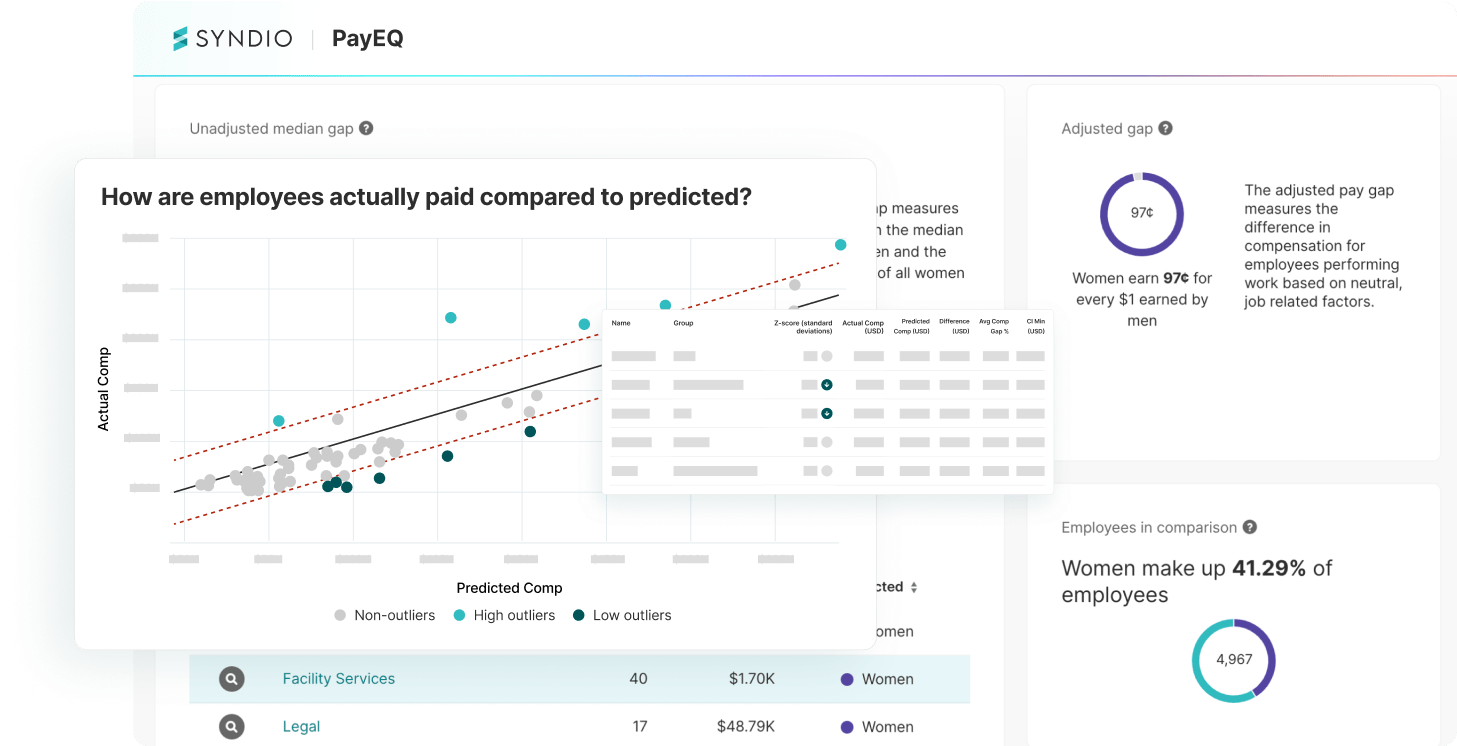

Compensation Consistency Analytics™

Run diagnostics to see where you are not paying according to your policies — so you can address outliers, ensure fair pay, and improve business outcomes.

Root cause analytics

Uncover specific drivers and root causes of pay disparities using statistical analysis, so HR teams can take corrective action.

Visualizations & reporting

Go beyond data tables to get a clear view of pay analysis and results. Download custom reports to communicate results and facilitate collaboration.

Enterprise-grade capabilities

Integrations & data management

Ingest data from any HRIS — including Workday — using secure integrations and data management capabilities that don’t require offline data manipulation.

Security & performance

Maintain attorney-client privilege and keep data secure with ISO 27001 and SOC2 certified, GDPR-compliant software with enterprise-level security and performance.

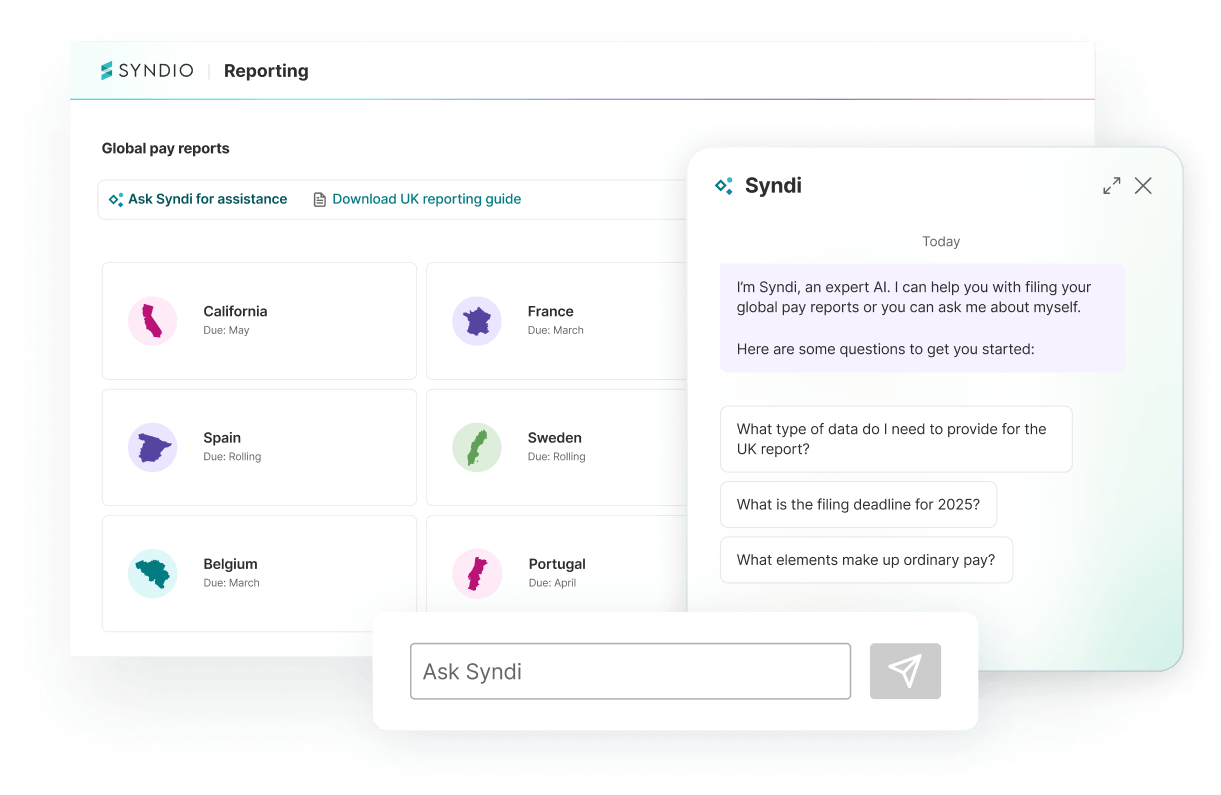

Global features & expertise

Ensure global compliance and strategic guidance from the only team with a deep set of experts, partnerships, features, and customers in Europe and the U.S.

Proven pay audit solutions for global enterprises

FAQ

PayEQ is a software solution designed to help organizations analyze, resolve, and prevent unlawful pay disparities and inconsistencies. PayEQ does not favor any one gender or race, exposing disparities and recommending remediation to ensure pay is lawful, non-discriminatory, and merit-based. Compensation and human resources (HR) professionals use PayEQ to achieve pay equity for all genders and races and ensure fair pay practices within their workforce.

Key features include:

- Fast and accurate analysis: PayEQ uses sophisticated statistical models to analyze pay data across an organization, considering factors like job level, experience, performance, and location. It can identify pay issues exponentially faster than traditional manual methods.

- Flexibility and configurability: Pay audits can be tailored to an organization’s specific needs, with customized comparison groups, control factors, and compensation measures. This allows organizations to align the analysis with their unique pay practices and legal requirements.

- Real-time insights: PayEQ provides an on-demand view of pay issues, allowing teams to monitor pay as often as they want and proactively address potential problems. Organizations can also analyze the impact of proposed pay changes before they’re implemented.

- Root-cause analysis: The solution helps uncover the root causes of pay disparities by analyzing the influence of different factors on pay and how that differs based on protected identity categories. Organizations can identify and address systemic issues within compensation policies and practices.

- Remediation and prevention: PayEQ provides tools to help remediate existing pay disparities and prevent future ones. The solution will allocate funds for pay adjustments and monitor changes, all while adhering to organization specific rules.

- Reporting and collaboration: PayEQ offers easy reporting features to share results with stakeholders and facilitate collaboration. Organizations can generate reports with rich visualizations to communicate findings and track progress.

PayEQ empowers organizations to move beyond simply “fixing” pay issues to actively monitoring and preventing them, creating a more equitable, transparent, and merit-based workplace.

PayEQ is flexible and configurable — offering multiple methodologies for dynamic reference groups, intersections, or outliers. Organizations can tailor the analysis to specific needs, including defining custom employee groupings, compensation types (base pay, bonuses, stock options, etc.), and control factors. Teams can also easily adjust the pay audit by adding or removing employees or factors.

Yes. Syndio’s PayEQ was created and designed by a team of experts — including labor economists, statisticians, and lawyers who have extensive experience in legal pay audits and litigation. They ensure the solution’s methodologies adhere to legal standards and best practices. In fact, the team reverse engineered lawsuit elements during the solution design.

The platform is transparent in its calculations and allows for customization of the analysis. This means customers can define comparison groups, pay policies, and compensation measures to ensure the analysis aligns with specific pay practices and legal requirements. More importantly, this transparency provides our customers with the ability to demonstrate a good-faith effort to comply with pay laws and can be valuable in legal proceedings.

PayEQ does not favor any one gender or race. It exposes issues that impact any group and recommends corrective remediation accordingly.

PayEQ is designed to help organizations comply with global pay transparency requirements and various pay equity laws and regulations — including the EU Pay Transparency Directive, the Equal Pay Act, Title VII of the Civil Rights Act, state-specific pay equity laws, and 2025 Federal Executive Orders. Syndio has been validated by independent third parties, including EDGE, Fair Pay Workplace, and other legal experts and academics.

Syndio understands the importance of attorney-client privilege in legal pay audits. We offer features and guidance to help maintain privilege throughout the process.

Yes. PayEQ supports intersectional analysis. This means that organizations can analyze pay not just for single demographic groups (such a gender or race), but also for the intersections of those groups.

PayEQ supports intersectional pay equity analysis with inclusive methodologies that account for the complex relationships between different demographic groups and pay. This ensures that the analysis accurately reflects the experiences of employees with intersecting identities.

Also, PayEQ includes intersectional budgeting that allows organizations to allocate funds to address pay disparities for intersectional groups. This ensures that remediation efforts are comprehensive and don’t inadvertently exacerbate existing inequities.

Organizations can understand the full scope of pay inequity and target remediation efforts effectively with PayEQ. The solution generates reports that highlight pay disparities for both single demographic groups and intersectional groups.

Finally, PayEQ provides visualizations that help you understand the pay gaps for intersectional groups, making it easier to identify and address specific areas of concern.

Compensation Consistency Analysis™ (CCA) is a PayEQ feature that helps organizations ensure fair and consistent pay practices across their entire workforce. It goes beyond traditional pay equity analysis to analyze and identify pay disparities without focusing on gender or race.

Here's how it works:

- Holistic view of pay: CCA analyzes organization-wide pay to consider all employees and various factors that influence compensation, such as job level, experience, performance, location, and skills.

- Outlier identification: By comparing actual pay to predicted pay based on compensation philosophy, CCA identifies outliers — employees who are paid significantly more or less than expected. This helps pinpoint inconsistencies and potential biases in pay decisions.

- Root-cause identification: CCA helps organizations understand the reasons behind pay inconsistencies. It analyzes the influence of different factors on pay, revealing whether disparities are due to legitimate reasons (like performance) or potentially problematic ones (like manager bias or inconsistent application of pay policies).

- Data-driven insights: CCA provides detailed reports and visualizations that highlight pay inconsistencies and their potential causes. This empowers organizations to have data-driven conversations with managers and leaders, promoting greater fairness and transparency in pay decisions.

- Proactive pay management: By identifying and addressing pay inconsistencies early on, CCA enables proactive pay management. This helps reduce the need for costly remediation efforts and legal disputes down the line.

Top resources

Novo Insights 2024 Report: Syndio is #1

Over half of leaders that use third-party pay equity software choose Syndio.

Navigating the new Executive Order

See how Syndio helps you achieve fair, merit-based pay.

Salesforce transformed their strategy

See how they scaled their pay equity approach with Syndio.

Compensation solutions for transparency

Uncover and resolve pay inequities and inconsistencies. Then improve underlying policies, and drive systemic change.