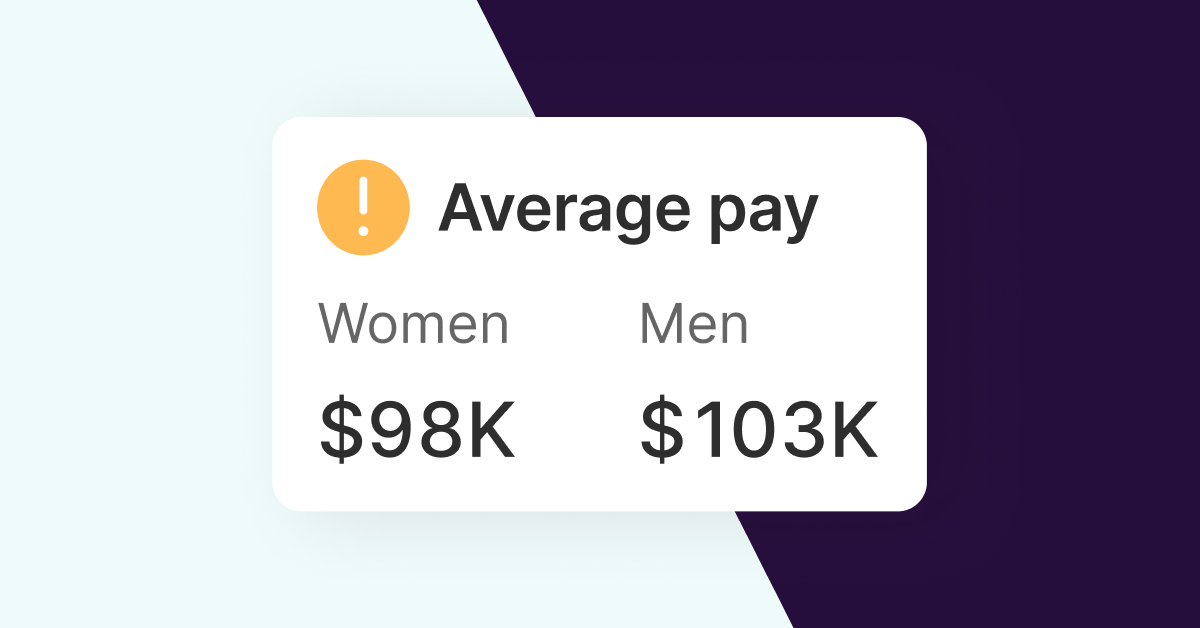

There are dozens of pay gap reporting laws across the globe that vary by country and jurisdiction. Some focus on pay equity, others focus on pay gaps, while others require a salary (wage) registry. The upcoming EU Pay Transparency Directive will add or amend reporting obligations, requiring compulsory pay equity analyses and remediation as well as public reporting on mean and median pay gaps.

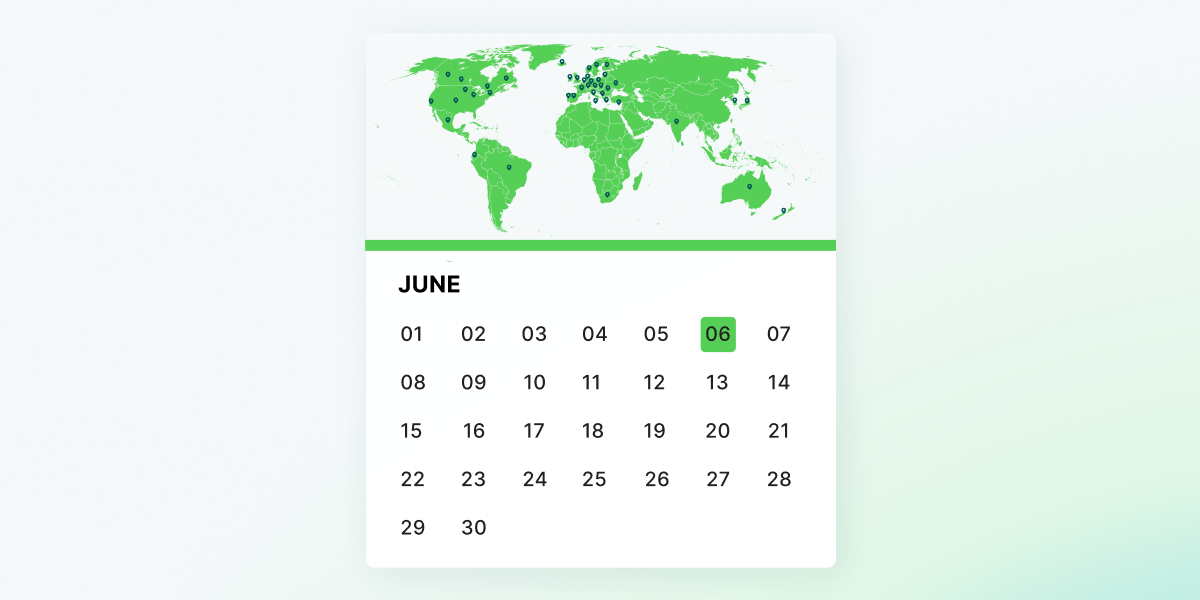

Here we provide compliance deadlines for 48 jurisdictions spanning 43 countries, so you can plan for your annual and ongoing reporting obligations. Need more information on where you need to report or details on requirements? Check out our Global Pay Reporting Calculator and comprehensive pay gap reporting guides.

Global pay gap reporting deadlines in 2025

January

Canada (Quebec)

South Africa if electronic

February

Brazil data due*

April

June

Canada (Federal) draft for feedback*

Israel

Japan but based on fiscal

Norway but based on fiscal*

Switzerland*

August

Brazil data due*

September

Canada (Federal) reporting*

Brazil published*

October

South Africa if manual

Ukraine*

November

December

Rolling or employer-specific deadlines: Canada (Ontario), Chile, Finland*, Germany*, Iceland, India*, Lithuania*, Luxembourg*, Spain*, Sweden, U.S. (Illinois)*, U.S. (Minnesota)*, Ukraine

The asterisk indicates the reporting is not annual. This reporting may be more frequent or less frequent.

Where does your company meet employee thresholds for pay reporting?

Use Syndio’s free Global Pay Reporting Calculator to get a list of countries where you owe reports — then get all the details on specific deadlines and requirements.

Best practices for global pay reporting

Here’s a look at how leading companies are creating a more efficient global pay reporting strategy. Follow these best practices to simplify your approach.

1. Centralize reporting.

Missing a report is never a good thing. With a distributed strategy, many companies don’t realize they qualify for a report — either because the requirements have changed, or because the employee threshold in a certain jurisdiction has increased and they’re now required to report. Managing reporting jurisdiction by jurisdiction is also a more expensive, unruly, and error-prone process.

By centralizing your reporting strategy, you can track compliance deadlines and thresholds in one place, ensuring you never miss a report.

2. Develop scalable processes.

One of the most difficult aspects of pay gap reporting is tracking and interpreting the disparate requirements and aggregating and analyzing all the data you need. Companies are turning to a new category of pay gap reporting software solutions to automate steps in this process.

At a minimum, these solutions calculate required metrics on your behalf, supporting the last mile of compliance and avoiding computational errors. Best-in-class solutions like Syndio’s Global Pay Reports do more: with clear templates for compiling data, data validation to ensure accuracy, and expert support throughout the process.

3. Prepare for the EU Pay Transparency Directive — now.

The EU Pay Transparency Directive will have a significant impact on pay reporting, requiring companies to publicly disclose and fix gender pay gaps that they cannot explain. The Directive will also introduce new pay transparency obligations.

Heading into 2025, savvy companies are taking steps to prepare for the Directive now. While the first pay reporting deadline is in June 2027, the report will be based on payroll data from 2026. So this year’s annual compensation cycle is your last chance to make adjustments.

For more information on how the Directive changes requirements and how to comply, visit Syndio’s EU Pay Transparency Directive page.

Step one for global pay reporting compliance? Understand where you need to report. Use Syndio’s free calculator to understand where your company meets employee thresholds for global pay data reporting requirements.