Performance management is a critical aspect of any successful organization, designed to identify and develop top talent while fostering a culture of growth and productivity. However, the current landscape of performance evaluation programs has revealed alarming issues of bias and distrust.

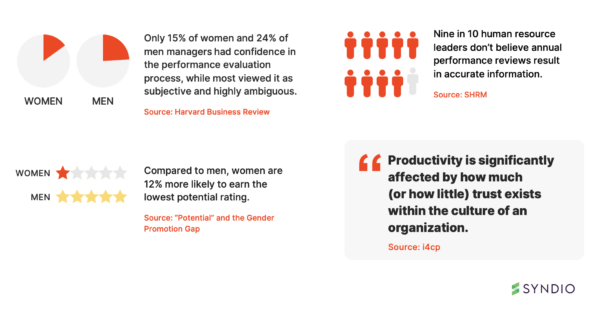

Recent statistics indicate that only a mere 15% of women and 24% of men managers expressed confidence in the fairness of performance evaluations, with most considering it subjective and ambiguous. Moreover, a staggering 90% of human resource leaders lack faith in the accuracy of annual performance reviews, highlighting the urgent need for improvement.

The evidence of gender disparity within these processes is also unsettling, with traditional ratings approaches often becoming a breeding ground for bias. Studies have shown that compared to their male counterparts, women are 12% more likely to receive the lowest potential rating, perpetuating unequal opportunities and growth prospects. However, while a Deloitte study found that the process is “universally despised,” 86% of companies still use performance ratings in some form.

So how can companies build a performance management process that effectively identifies, rewards, and develops top talent, without bias?

To help uncover best practices, we hosted a webinar on How to Develop a More Equitable Performance Management Program, featuring Elizabeth Roseman, Head of Total Rewards at Corebridge Financial; Lynn Moffett, Vice President of Human Resources at BMC Software; and Courtney Benjamin, Head of Diversity, Equity & Inclusion at Bungie, moderated by Syndio CEO Maria Colacurcio.

Below we’ve distilled their top advice for analyzing your current performance management program to address bias and improve equity throughout the entire process.

1. Identify key areas where you can actively mitigate bias and increase objectivity in the process.

“There’s a lot of power in natural language in uncovering some of this unconscious bias. One of the companies I worked at did a presentation after the review cycle that gave statistics about how frequently a particular word was used, more often than in another type of review. [For example], the word bubbly was used at a 10x factor in reviews of females than males… I think having that reflection moment of ‘Wow, it’s not just the outputs of the data, but if performance reviews are subjective and there’s words [involved], then let’s look at the words.”

– Elizabeth Roseman, Head of Total Rewards at Corebridge Financial

The subjective nature of ratings and reviews means that bias can potentially seep in, which is why it’s important to find ways to move towards more objective evaluations. While true objectivity might not be achievable due to inherent biases, you can identify ways to reduce bias as much as possible in the process. Subjective goal assessments, lack of digital measurement tools, and cognitive biases such as the recency effect can all skew perceptions and impact the accuracy of ratings and reviews. Becoming aware of and addressing these issues can significantly impact the quality and fairness of evaluations.

One important area to pay attention to is the language used in performance reviews. Evaluating the natural language used in performance reviews can reveal unconscious biases. Implementing tools that prompt reflection before submitting reviews can help managers be more aware of potential biases in their language.

Additionally, using behavior-based questions and ratings such as a ten-point scale can also make the review process feel less scripted and more insightful. Highlighting self-assessment blind spots can further promote personal development. Utilizing a 360-degree feedback structure can be beneficial in gaining multiple perspectives on an employee’s performance, further enhancing the accuracy and fairness of the review process. Finally, take care with calibration meetings as they are another potential entry point for bias in the performance review process.

2. Move to development-focused, future-forward performance management, emphasizing employee growth.

“The way that we have chosen to reduce the subjectivity within performance rating…[is] to keep it very development-focused. We really want to ensure that managers [are] focusing on the person and their goals, right? It’s less about us talking as managers, but listening to the goals and the successes of your direct report is wanting to share…. The other piece I would say is to maintain that future focus approach. Performance reviews are backward looking, but there are ways that you can keep that future-focused approach.”

– Courtney Benjamin, Head of Diversity, Equity & Inclusion at Bungie

Performance reviews are traditionally very backward-looking, but companies can shift to viewing the process as an opportunity for growth and development by emphasizing employee career development and future goals. By shifting the focus from merely assessing past performance to emphasizing development and future goals, the performance review process becomes a catalyst for continuous improvement. This approach ensures that individual goals align with organizational objectives, fostering a human-centered and intentional evaluation process.

One of the key advantages of a development-focused approach is that it offers valuable opportunities for providing comprehensive feedback. Beyond assessing the results achieved by employees, this approach delves into evaluating their workplace behaviors, attitude, and overall contributions. This provides employees with insights into their strengths and areas for further growth and development, nurturing a culture of continuous learning.

To implement development-focused performance management programs successfully, companies should move beyond the traditional emphasis on ratings. Instead, they can adopt behavior-based reviews that delve into the actions and qualities demonstrated by employees in their roles. By using behavior-based questions and evaluations, managers can gain a deeper understanding of employee performance, identify blind spots, and offer targeted guidance for growth.

3. Improve manager capability around feedback.

“We have the opportunity to retrain during these processes [to] refresh managers on places where their unconscious bias may be creeping in. And I think that we can continue to use data and analytics more and more as we progress. I think there’s a lot of untapped potential in that data to help managers see the places where they don’t think they’re being biased, but we may be able to identify it through data and over time and really have them have even more reflection moments when they’re writing their reviews.”

– Elizabeth Roseman, Head of Total Rewards at Corebridge Financial

As Elizabeth stated during the webinar, “The antidote to unconscious bias is active inclusion.” To counter bias in performance management programs, Courtney highlighted the importance of developing manager capabilities in providing and receiving feedback. Effective feedback practices not only nurture a feedback-driven culture but also serve as an avenue to counteract biases.

Over-engineering the review process can create unnecessary reliance and burden on managers, leading to subpar outcomes. Elizabeth framed three key focus areas for improving manager involvement in performance reviews: “clarity, consistency, and simplicity”:

- Be clear about purpose and value in communications: Communicate early and often throughout the performance review process to set clear expectations and objectives. Breaking down training into manageable chunks can facilitate better retention and application of knowledge. It’s also essential to communicate the purpose and value of performance reviews clearly to managers. This helps managers understand the significance of the exercise and its impact on employee development and organizational success.

- Use analytics to ensure consistent application of policies: To achieve meaningful results, consistency is key. Organizations should ensure that their actions align with their statement — for example, if you say you “pay for performance,” does the data back that up in practice? Additionally, data and analytics can play a pivotal role in helping managers identify areas where their unconscious biases may unknowingly influence their decisions. By leveraging data insights, managers can have more reflective moments while crafting performance reviews, leading to more objective assessments.

- Leverage technology for simplicity: Embracing technology and automation can simplify HR tasks for managers, making the performance review process more efficient and effective. By streamlining processes, organizations free up managers to conduct more thorough, consciously, and reflective reviews.

4. Leverage data analytics to ensure you pay for what you say you pay for.

“[Performance management] is not an area that has been digitized quite as well. Although your systems and your frameworks do help managers to get through this process, I think we could evolve here in leaps and bounds and really help managers take some of the lift off.”

– Lynn Moffett, Vice President of Human Resources at BMC Software

Elizabeth said during the webinar, “If you want to drive a result, then you have to [get] tools that support it and then reflect on the data to check yourself.” Data analytics are crucial to keep your pay policies honest and ensure you actually pay for what you say you pay for.

For example, if you say you pay for performance and Employee A earns more than employee B in the same role — can you pinpoint why they have a difference in salary? Is Employee A’s salary truly a reflection of their contributions? Is another factor like tenure or education driving the pay difference, rather than performance? Could there potentially be unlawful inequities related to race or gender contributing to the gap?

Syndio’s Pay Policy Analytics solution holds up a mirror to pay policies to see if they’re working as intended, or if other factors are driving differences in pay. By making informed decisions based on data insights, organizations can optimize compensation strategies and better align pay with actual performance measurements.

5. Define and be more transparent about “pay for performance”.

“We’re not pay for performance… We have market adjustments in the fall, and then we have four times a year now we’re moving into that where managers can choose to promote folks on their team and then that of course, is where folks could get a bump in their salary or in their pay. Anytime that there is a performance adjustment or move across the organization we feed that data back into the Syndio platform because we really want to ensure as we’re making these movements and these small adjustments, that there’s no adverse impact across the organization.”

– Courtney Benjamin, Head of Diversity, Equity & Inclusion at Bungie

“I often recommend not focusing your pay for performance strategy on merit. It’s the law of small numbers. If you’ve got 3% or 3.5% or 2.5% you’re going to spend a lot of energy to not make a meaningful difference for a colleague, and they won’t then see it. So I tend to focus that pay for performance linkage in the variable pay. But it takes a lot of effort and a lot of alignment of your senior leadership team. Everyone wants to say their pay for performance, but do you really mean it?… One anecdote of what has worked well at one of the companies I’ve worked at before is proximity. So that time bias, having a mechanism in your pay for performance strategy for quick recognition of good performance or good behavior, we found that worked extremely well, allowing managers or peers throughout the organization to recognize, even with small dollar values, good work and good performance.”

– Elizabeth Roseman, Head of Total Rewards at Corebridge Financial

Many companies are struggling to balance financial incentives with budget limitations, which in turn means employees struggle to see how their performance is tied to merit increases. By exploring alternative approaches, leveraging data and analytics, and embracing pay transparency, companies can create a more meaningful and equitable pay-for-performance system that motivates employees and drives organizational success.

- Use data analytics to understand how your pay policies play out in practice: As discussed in section 4 above, data analytics play a pivotal role in understanding pay-for-performance relationships and identifying trends. Syndio’s Pay Policy Analytics solution can pinpoint the factors that actually drive pay in practice, so you can better align your policies with desired pay outcomes.

- Determine how best to reward for performance. When we talk about pay for performance, we often think first of base salary. However, the factors that drive differences in pay in base salary are often more job-related. That is, the level of the job, the experience and skills a person brings to the job, and even the job’s location are typically the factors that contribute the most to how a job is paid. When we analyze the influence of performance ratings on base pay, they are typically contributing to a lesser degree than these other factors. While yearly increases are called “merit,” they are administered with consideration of the competitiveness of pay (e.g., compa ratio) as well as with little room for differentiation between levels of performance (e.g., 4% budget).

- Shift focus to variable pay (short-term incentives): Since merit-based pay might not be the most effective strategy due to small differences in percentages, leading to limited impact on employees’ perception of how merit impacts their pay, one solution is to use short-term incentives as the primary drivers of pay for performance. Short-term incentives can focus employees and teams on specific behaviors and activities that can be measured and rewarded in more frequent increments. By better-defining the metrics of performance, companies can effectively differentiate rewards based on performance outcomes, promoting a stronger connection between effort and compensation.

- Adjust the proximity and frequency of recognition and rewards: Create more frequent performance “check-ins,” such as quarterly discussions of performance. By implementing mechanisms for more immediate recognition of exceptional performance throughout the year, companies can more closely link behavior and rewards, better motivating employees. Another benefit is that aggregating these moments of recognition and feedback points in a pre-populated year-end review can mitigate year-end recency bias and enhance the accuracy of performance evaluations.

- Explore additional ways to “pay for performance”: Bungie focuses on market adjustments and quarterly opportunities for managers to promote team members, using ongoing equity analyses in the Syndio platform to ensure there’s no adverse impact on the organization. Some organizations also place guardrails around where employees are expected to be positioned within pay ranges based on performance outcomes. Finally, some organizations leverage long-term incentives to reward sustained high performance and contributions over longer periods of time that contribute to long-term value for the company. The focus on a broader definition of rewards and the careful consideration of equity in each action helps ensure fairness from moment to moment. This multifaceted approach to rewarding performance provides better value for both the organization and employees.

- Use tools to maintain consistency and differentiation: Continuous monitoring of pay and recognition decisions is necessary to ensure your organization is delivering on its promise to pay for performance. For example, Syndio’s customers conduct pay variation analyses using Pay Policy Analytics to unpack what is driving pay differences, including how much performance is influencing pay. Understanding the impact of performance ratings (e.g., distribution of ratings, merit increase outcomes, etc.) and taking measures to ensure consistency is crucial to ensuring fairness and equity across the organization.

- Embrace pay transparency and ‘pay explainability’: Be intentional about explaining pay decisions to employees. Gartner found that “Only 38% of the employees we surveyed report that they understand how their pay is determined” — but when organizations educate employees about how pay is determined, employee trust in the organization increases by 10% and pay equity perceptions increase by 11%. Use data and analytics to ensure equitable pay and optimize compensation programs around the need for communicating about pay.

It all comes down to trust.

Why does inequity in performance management programs matter to the business? Because productivity suffers amidst distrust. A new report from i4pc found that “Productivity is significantly affected by how much (or how little) trust exists within the culture of an organization.” Bias can’t be ignored. Begin the journey towards making performance management more equitable now, taking it step by step, and consistently working to refine and enhance the process over time.

The How to Develop a More Equitable Performance Management Program webinar was filled with valuable advice, so watch the full webinar recording linked below for more insights.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.