Since 2017, the United Kingdom has required all private employers with more than 250 employees working within the UK to report their gender pay gap annually, based on the snapshot date of 5 April. The report is due any time on or before 4 April of the following year. Below, we highlight some of the key things to know about gender pay gap reporting in the UK.

What are the reporting requirements?

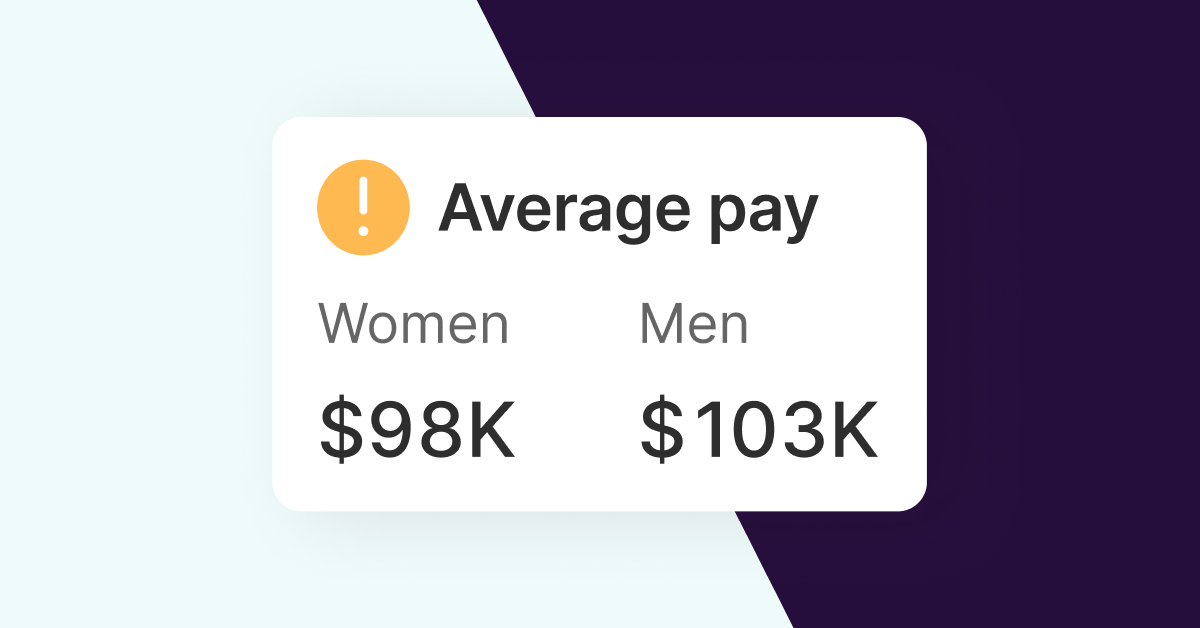

The gender pay gap is the comparison of the median or average pay of women versus the median or average pay of men across your organization. The UK requires this to be expressed as a percentage of men’s earnings, for example: “Women earn 20% less than men.”

Along with the pay gap calculations, a private employer must prominently publish a written statement on its website and keep it available for at least three years from the date of publication. The written statement must contain a supporting narrative explaining your organization’s view of why the pay gap is present, what you’ve done to analyze it, and your plans to close it. The written statement must be signed by an “appropriate person” who confirms the published information is accurate.

Submit your pay gap percentage calculations and data to the UK’s Gender Pay Gap Service, along with a link to your public statement. Calculations include:

- Percentage of men and women in each hourly pay quartile

- Average and median gender pay gap of hourly pay

- Percentage of men and women receiving bonus pay

- Average and median gender pay gap of bonus pay

Which employees should be included in these calculations?

You will need to identify two populations:

- Relevant employees include anyone who has a contract of employment, including part-time and employees on leave. This group of employees should be included in your bonus pay gap calculations.

- Full-pay relevant employees (a subset of relevant employees) are employees who received their usual pay during the pay period in which the snapshot date occurred. This group of employees should be included in your hourly pay calculations.

For more details on how to determine these populations, visit the UK government’s guide here and consult your legal counsel.

What data should I gather?

For each relevant employee, you will need to gather hourly pay, bonus pay, weekly working hours, and demographic (gender) data.

How often is reporting required?

UK gender pay gap reporting is due every year, on or before 4 April, using data as of the snapshot date of 5 April of the previous year. Work with your legal counsel to ensure your reporting complies with UK law and is posted on time.

Can Syndio help with UK gender pay gap reporting?

Syndio helps our customers analyze and complete pay reports for compliance with many pay reporting requirements around the globe, including the UK. Our team of Expert Advisors actively track and support many global analyses, either within the Syndio platform or provided offline as a custom report run by our team. We offer a UK reporting template and, under the direction of your legal counsel, we can offer assistance with calculating the metrics, filling in the reporting template, and documenting the results.

If you’d like to learn more about how Syndio can help simplify UK gender pay gap reporting for your company, reach out to our team below.

We can also assist with multinational companies — check out our Global Pay Reporting Cheat Sheet below for an overview of pay reporting laws and requirements in 15 key jurisdictions across the world — and guidance for how leading brands are approaching global pay equity.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.