For years, organizations have developed their environmental, social, and governance (ESG) approaches in response to pressures from consumers and investors, as well as an acknowledgement that these programs support the long-term profitability of the firms. Interest in the social component surged after the murder of George Floyd in 2020 as organizations sought to respond to social pressure in a way relevant to their businesses. While the past year has seen a backlash to the increased emphasis on ESG measures, certain measures are now table stakes for consumers and investors alike.

Last year, we tracked dozens of workplace equity investor proposals at F100 companies that supported the ‘S’ in ESG measures, from pay gap disclosures to civil rights audits. While most of these failed to pass at the shareholder vote, several passed and many gained substantial levels of shareholder support — and definitely got management’s attention.

These proposals exemplified the increasing demands placed on employers to demonstrate a meaningful commitment to workplace equity. In the 2023 proxy season, we saw an increase in the number of pay gap disclosure proposals, but a slight decline in the average amount of support for each proposal.

How did major shareholders vote?

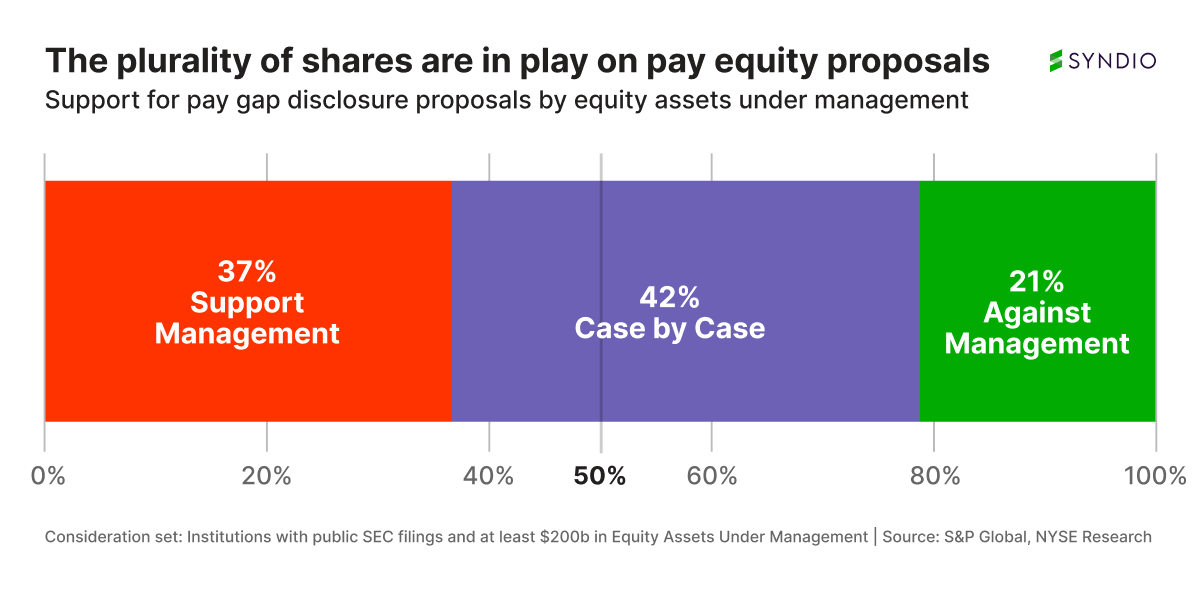

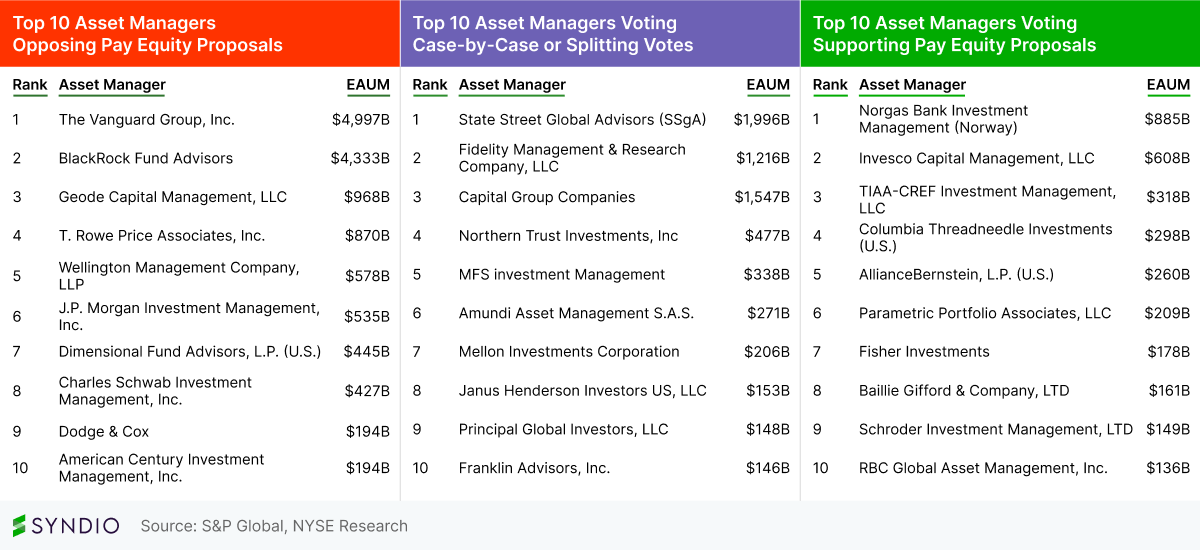

We analyzed specific investors’ voting patterns on 10 of the 11 pay gap disclosure shareholder proposals we tracked in the 2023 season using data from S&P Global and NYSE Research. We classified major investors as:

- Supporting management and voting against these proposals

- Siding against management and voting in favor of the proposals

- Those that voted on a case-by-case basis, siding with management on some proposals and against on others, or whose shares were meaningfully split on individual proposals

Each publicly traded company’s mix of shareholders varies, so the breakdown of how your shareholders would vote will vary from this sample. Additionally, not all investors are required to disclose how they voted, representing an unknown batch of shares. This includes some large managers (like Berkshire Hathaway) and a long tail of smaller institutions. The excluded proposal took place after the filing deadline, and the investors included here logged votes on an average of 8.8 of the 10 potential proposals.

As was the case in our analysis of investor behavior in the 2022 proxy season, the plurality of potential votes from major shareholders are “swing votes” and vary between support and opposition depending on the company’s goals, policies, and disclosures related to workplace equity.

We did see a significant chunk of shares moving towards more support for management, reflecting the lower average support these proposals received in years past. Funds managed by BlackRock had previously voted case-by-case, but in 2023 sided with management (along with other E&S related proposals)— and the same story held for Geode Capital Management, Charles Schwab Investment Management, and others. Capital Group Companies switched from voting against management in 2022 to case-by-case support, while Wellington Management Company voted against management in 2022 but sided with management in 2023.

A handful of managers — most notably Norges Bank — moved in the opposite direction, with more support of pay gap disclosure proposals. Goldman Sachs Asset Management abstained from pay equity votes, and previously had sided with management.

How can you prepare for a potential shareholder vote?

Though there is still substantial support for these pay gap disclosure votes, support was lower in 2023 than in 2022. This may reflect decreased interest from asset managers in supporting this type of proposal, but it also reflects these organizations having their houses in order to oppose these proposals with the right commitments, policies, and disclosures.

Attorneys from Orrick noted characteristics of companies that fended off these proposals, which we detailed in our roundup of the 2023 proposals, including:

- Diversity goals at the management level

- Reporting adjusted pay gap data

- Conducting pay equity analyses

- Public commitments to pay equity

- Publishing diversity data

When organizations demonstrate an intentional commitment to workplace equity, both in terms of pay equity and opportunity equity, they are more likely to gain shareholder support.

“We’ve talked to numerous investor ESG research and stewardship teams that report they are facing increasing regulatory scrutiny, and they say they are becoming more deliberate in documenting how they align their voting decision-making process with value creation,” said Brian Matt, Director & Head of ESG Advisory at New York Stock Exchange. “This should give companies that maintain dialogue with their shareholders an opportunity to tell their story.”

Matt continued, “Also, an increasing number of pay equity proposals making it to a vote this year means more investors have had to evaluate companies’ approaches to justify their votes — and should offer a better baseline for companies to describe what they’re doing on pay equity relative to others. In short, you will likely find a better-informed audience within your investors to discuss workplace equity issues, either in the context of a shareholder proposal or simply your ongoing dialogue around human capital management.”

“You will likely find a better-informed audience within your investors to discuss workplace equity issues, either in the context of a shareholder proposal or simply your ongoing dialogue around human capital management.”

– Brian Matt, Director & Head of ESG Advisory at NYSE

Workplace equity is here to stay

In Syndio’s 2024 Workplace Equity Trends Report, the vast majority of enterprise organizations indicated that their workplace equity programs would remain a priority for at least the next 24 months. While these pay gap disclosures proposals continued to gain steam in the 2023 proxy season, management tended to win more support this year than last. We expect that 2024 will include even more shareholder proposals pushing for pay gap disclosures, particularly as more states and the EU propose and pass more robust workplace equity legislation.

How those proposals fare — and whether any gain majority support — depends on how prepared publicly-traded companies are to demonstrate their commitment to workplace equity.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.