This four-part series is brought to you by the letter ‘S’ in ESG — diving into what social impact means for companies, how focusing on workplace equity can help deliver on the ‘S’, how it is critical for business impact, solutions for reporting, and how to communicate it internally and publicly.

Responsible investing that takes into consideration environmental, social, and governance factors, known collectively as ESG, has become one of the hottest topics of conversation in investment analysis. This is evidenced by the fact that 85% of investment professionals included ESG factors in their investing decisions in 2020 — and poured $649 billion into ESG-focused funds during the first 11 months of 2021.

And it’s not just investors who use ESG as a decision-making tool. Over half of employees now consider an organization’s ESG commitments when assessing a potential employer.

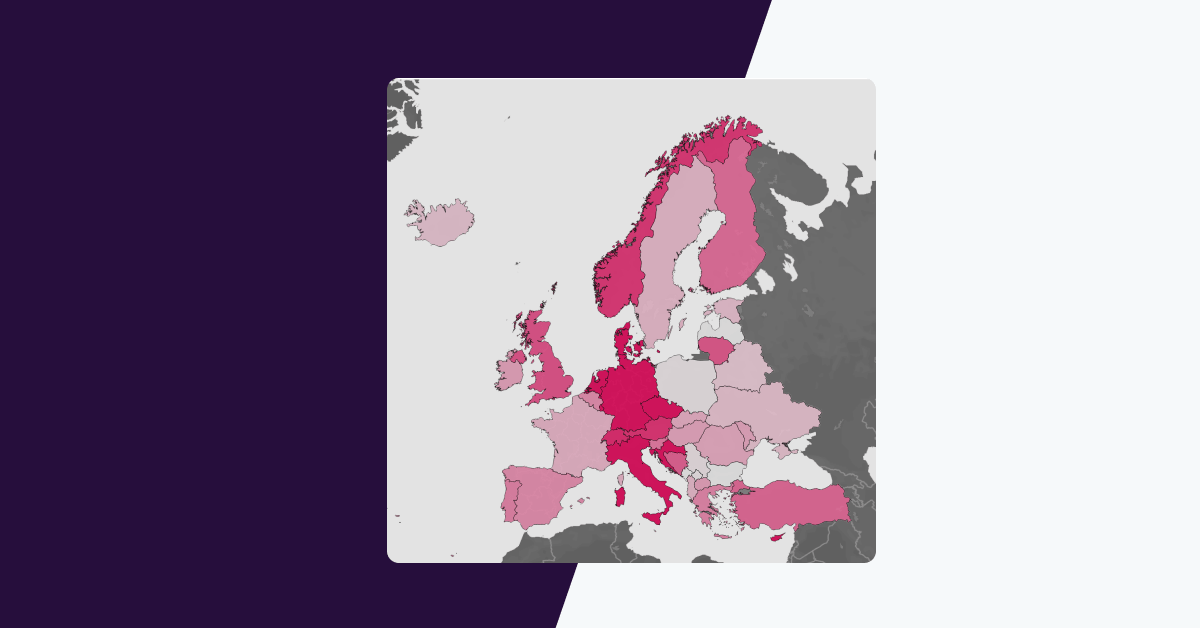

This growing pressure is, in turn, driving more and more U.S. companies to voluntarily disclose some ESG-related data (Europe and other countries have mandated ESG reporting requirements). However, while the environmental aspects of ESG, such as carbon neutrality, renewable energy, and green building, have gained mainstream recognition with investors and consumers alike, the ‘S’ in ESG has remained somewhat overlooked. This is largely due to the historical difficulty of defining and quantifying social impact, despite the fact that social initiatives are proving vital to company reputation and performance.

So where does that leave the ‘S’ in an era where pressure for social impact transparency and action is building from every direction? What’s the role of workplace equity in the ‘S’? And how does it affect business?

Why workplace equity should be at the core of the ‘S’ in ESG

There’s no singular definition of exactly what “social” entails within ESG frameworks — and that’s a big part of the problem of why social impact reporting has generally remained inconsistent and vague. A quick online search yields a broad range of definitions for the ‘S’: from relationships with people and institutions, to stakeholder outcomes, to employee, customer, and community interactions and impact, to the simple question, “What is an organization doing to improve lives?”

While this all sounds rather soft and qualitative, the ‘S’ should not be considered intangible. One main quantitative driver at the heart of this web of interlinked social factors is workplace equity, which encompasses pay equity and opportunity equity. Workplace equity is a crucial yardstick for social impact because it measures actual employment outcomes: are employees being paid equally for equal work and are they receiving the same opportunities for advancement?

Due to expanding pay disclosure legislation and pay transparency demands from both employees and investors, pay equity specifically is on track for increasing scrutiny. It benefits companies to get ahead of the narrative and be transparent about their pay equity progress alongside other workplace equity and social impact metrics.

Pressures to report on the ‘S’ in ESG

A culmination of recent events — including the pandemic, social justice movements, and a tight labor market — have led to employees reconsidering their role in the economy and demanding more power in the workplace. This upended power dynamic has had ripple effects throughout the various forces that influence and impact corporate decision-making, building 360 degrees of pressure on companies to elevate social factors in their ESG reporting.

Regulatory and legislative bodies: While the U.S. does not yet have federally mandated reporting requirements, ESG reporting is already mandatory in Europe and other countries. The Securities and Exchange Commission (SEC) is increasingly focused on ESG transparency and recently proposed rules to standardize climate-related disclosures on ‘E’ related risks and metrics. It’s only a matter of time before standards are set for ‘S’ reporting as well, especially as the SEC has indicated it is considering recommendations to enhance board diversity and human capital management disclosures. Meanwhile, the Biden administration has an ambitious agenda for advancing gender and racial equity for federal employees and is considering new rules to enhance disclosure around board diversity and human capital management. Legislation is also catching up to pay transparency demands, with more and more states passing salary range disclosure laws.

Investors: Sustainable and responsible investing is increasingly becoming the default as investors seek to align their investment strategies with their values (while also benefiting from the proven upside of ESG investments). 99% of millennial investors consider social responsibility in their investment decisions and, in 2021, ESG funds accounted for 10% of worldwide fund assets. However, only one in ten investors found the ESG information they were looking for in corporate disclosures. Investors are therefore exerting pressure on companies to disclose more about their ESG strategies and outcomes. Companies ignore investors at their peril. A new phenomenon of proxy votes on median pay gap reporting hit some of the biggest corporations in America in recent months. Today’s investors clearly recognize that social issues such as equity and diversity have become critical success factors influencing employee retention, consumer loyalty, and brand reputation — and are demanding accountability.

Employees: The workforce in today’s competitive talent market expects more from employers in all areas, including an expectation for greater social purpose out of their careers and the companies they work for. 76% of workers believe that companies have an obligation to be a force for good in society and 95% of employees believe businesses should benefit employees, customers, suppliers, and the communities they operate within — not just shareholders. These beliefs are influencing how workers evaluate potential employers and whether they stay at jobs. The top 3 things that young millennials and Gen Z workers look for in employers are whether the organization cares about employees’ wellbeing, has ethical leadership, and is diverse and inclusive of all people. Three out of four knowledge workers would not be likely to accept a job if their values did not align with a potential employer’s and 52% would be likely to quit their job if values do not align.

Consumers: A combination of the pandemic and social justice movements have brought social issues to the forefront of public awareness in the past two years, with many consumers speaking with their pockets to show support for socially ethical companies. In fact, 77% of consumers are motivated to purchase from companies that show public commitments to making the world a better place.

Financial stakeholders: Research presented at the 2021 Gartner CFO and Finance Executive conference revealed that 91% of banks monitor ESG factors, along with 24 global credit rating agencies, and over 90% of insurers. Additionally, 67% of banks screen their loan portfolios for ESG risks while ESG considerations have caused insurers to limit coverage in certain sectors.

However, not all metrics are equally valuable. An NYU Stern analysis of social metrics for various ratings frameworks found that 92% focused on measuring company efforts and activities — not outcomes or impact. But investors and the public are becoming more sensitive to what they see as hollow performative actions. Just as on the environmental side of ESG where skin-deep, marketing-focused sustainability efforts are being called out as “greenwashing,” employees, investors, and the public are demanding progress over promises for social issues.

It’s no longer enough for companies to make public pledges — social stakeholders want proof through quantifiable measurements, reporting, and transparency. This was on display during Women’s Equal Pay Day 2022 when a Twitter bot exposed the gender pay gap at companies who were tweeting platitudes about women’s empowerment. It’s clear that brand reputation is at stake when metrics that measure actual outcomes, such as pay equity, don’t line up with corporate commitments.

How the ‘S’ benefits your business

More and more data is revealing that positive performance around ESG factors in general — including social factors specifically — lead to competitive advantage, higher returns, and increased market relevance. The Stanford Social Innovation Review explores why social factors in investment analysis should be viewed beyond how they affect risk (a negative), and instead focus on how they maximize returns (a positive).

Thus, instead of hiding social impact factors such as pay equity in the shadows for fear of exposure or viewing them as box-ticking compliance and risk mitigation exercises, transparency around ‘S’-related efforts and outcomes should be seen as a business opportunity which can yield:

Improved financial performance: S&P Global Ratings analyzed more than 2,000 studies on the impact of ESG investment considerations — 90% found that considering ESG factors led to average or above-average returns. The Harvard Business Review cites a 2018 study that found that “firms with a better ESG record than their peers produced higher three-year returns, were more likely to become high-quality stocks, were less likely to have large price declines, and were less likely to go bankrupt.” And, in a 2019 report, McKinsey identified five ways that a strong ESG profile is linked to higher value: namely, through contributing to top-line growth, cost reductions, reduced risk of regulatory and legal interventions, productivity uplift, and investment and asset optimization.

Boosted brand reputation: Brand reputation has overtaken investment returns as the main ESG driver, per the ESG Global Survey 2021. In another 2021 survey, 78% of respondents put “brand name and reputation” at the top of the list for reasons to engage in ESG efforts. And the impact is expected to be felt in the near term, as 92% of leaders in a 2022 survey thought that ESG issues would affect corporate reputations in the next 12 months.

Increased employee loyalty and productivity: Employees are three times more likely to stay and 1.4 more times more engaged if they work at a purpose-driven company. When employees believe their work has “special meaning,” rather than being “just a job,” they are 56% more likely to contribute to innovation. Companies on Fortune’s “100 Best Companies to Work For” list generated up to 3.8% higher stock returns per year than their peers over 25 years. And social issues such as pay equity have become a key component of employee loyalty: 58% of U.S. employees — and 70% of Gen Z employees — would consider switching jobs for more pay transparency.

“These [ESG and human capital] areas are not just nice-to-have or an expression of social responsibility; they’re existential. Companies are increasingly realizing that stronger human capital will help them improve the customer experience and respond to the vicissitudes of the marketplace.”

Semler Brossy, ESG & Human Capital Management Insight, 2021

Up next: Workplace equity metrics to use for reporting on the ‘S’

It’s clear that the ‘S’ in ESG will continue to grow in influence as a driver for investment analysis, and therefore corporate decision-making. Companies face “surround sound” calls for transparency and communication around their social impact efforts and outcomes —and, it turns out, doing so is also good for the bottom line.

So where should companies start when it comes to quantifiable disclosures around social impact? In our second post in this series, we discuss why the ‘S’ has traditionally been harder to measure than other ESG factors and provide recommendations for the top workplace equity metrics to use in ‘S’ reporting.