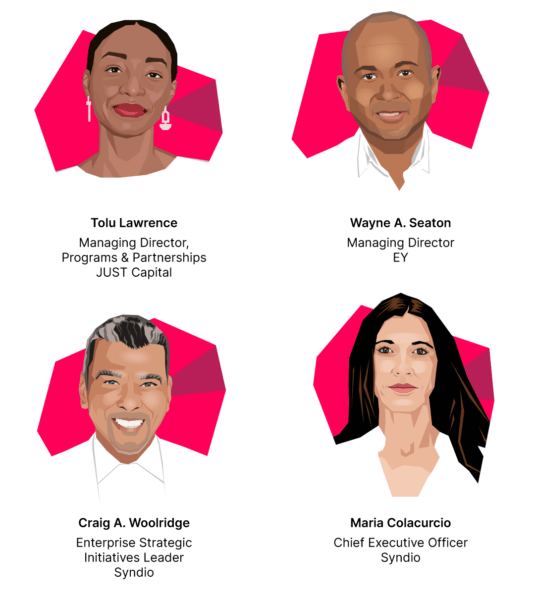

- Tolu Lawrence, Managing Director, Programs & Partnerships, JUST Capital

- Wayne A. Seaton, Managing Director, EY

- Craig A. Woolridge, Enterprise Strategic Initiatives Leader, Syndio

- Moderator, Maria Colacurcio, CEO, Syndio

Maria opened the discussion by noting key points about the rising importance of ESG in investing: 85% of investment professionals included ESG in their investing decisions in 2020 and poured $649 billion into ESG-focused funds. And of the 86 publicly traded proposal-eligible companies in the Fortune 100, 17 faced shareholder proposals for civil rights audits or similar diversity reports in the most recent proxy season.

Tolu, Wayne, and Craig shared insights around why and how the ‘S’ in ESG matters to investors; here are some of the top soundbites from the webinar.

Why are boards and shareholders more focused on the ‘S’ in ESG now than they were? What has gotten us to this point?

“Investors are pushing companies to better explain how ESG and specifically the ‘S’ factors are affecting the bottom line in their valuation.” – Wayne A. Seaton

Wayne A. Seaton: “You’re seeing pressure from society, from communities, on companies over issues like climate change and DEI. And these are all hopefully not just the passing fancy of what happened a few years ago; it’s still happening today.

“It has happened for 100 years, but really rose to prominence with George Floyd. So we have shareholder pressure, and there’s increasing demand daily, for companies to actually disclose how ESG issues affect their business. And this ultimately channels into valuation. There are studies that show that over time, ESG factors that are ingrained in companies tend to increase their value, and that ultimately these companies outperform the market.”

Craig A. Woolridge: “I was having a discussion with a Chief Financial Officer recently and he said, ‘What keeps me up at night is retention… because with this Great Resignation that’s going on right now, if you lose employees or your employees are not happy, you’re going to have poor performance. I mean, it’s a direct correlation.

“And finally, companies are realizing this: It’s good for business when companies can say, ‘Hey, we’re not doing it 100% right, but we’re going to figure out the potential causes of these problems and these gaps and we’re going to correct them.’ And then companies are admired for doing that.”

Can you address disclosure and how you counsel companies, specifically public companies, about communicating their ESG strategies?

“What you don’t want to have happen is for some activist investor to get hold of the fact that either there’s a lack of strategy or a deviation from a stated strategy in terms of achieving measurable impacts and outcomes.” – Wayne A. Seaton

Wayne A. Seaton: “In the beginning, as they say, ESG was nice to have. Now we’re seeing it has evolved to a must have. What we have been advising in terms of disclosure is to move beyond the initial creation of ESG strategy, which was really buried in the philanthropic and the CSR (corporate social responsibility) realms, and moving toward not just voluntary disclosure, but in some respects what would be required.

“Some companies today actually are doing a very good job of that, embracing not only a CSR report but a sustainability report. It’s published on a website or might be a separate standalone document [such as] having a TCFD (a Task Force on Climate-Related Financial Disclosures) report or having a gap analysis that actually identifies the gaps. It may be that equity is a gap, but it is something on the continuum of a corporate landscape and a corporate journey communicating this in a proactive way to stakeholder groups.

“So if a company wants to do a very good job of communicating ESG, and specifically the ‘S’, which as you mentioned is one of the more new and in some respects more nebulous ways of quantifying ESG, then tying that into the full materiality concepts and disclosing it is something that we find often helps companies maintain their interest based on stakeholder value as well as shareholder value — and ultimately value in the marketplace.”

Looking specifically at banks and investment funds: What do you think their response will be to this kind of backlash now arising around ESG? And where do you think that will leave the ‘S’ since a lot of the controversy is around the climate pieces?

“I think companies like Chase, with Jamie Dimon committing $30 billion of assets towards diversity and inclusion, that makes a huge statement. And like most companies on Wall Street, one follows the other.” – Craig A. Woolridge

Craig A. Woolridge: “Companies across all sectors have been directed by stakeholders — and their boards are asking for accountability. So I think the faster companies and financial institutions get their arms around this, the better. And so I think it’s important for financial institutions — banks, investment banks and asset managers — to lean in and really ask those hard questions about what’s going on for the ‘S’ within their organization.”

Tolu Lawrence: “Companies are starting to understand that absolutely there’s a moral imperative behind this work, but also starting to get their arms around the business case. And I think boards have been turning toward really understanding the risks and opportunities there, whether they’re based on reputation or brand, or really thinking about strategy financing human capital regulatory compliance.

“I think folks are starting to understand how to pull the thread through and that it’s not solely about company culture, but that really when we’re talking about human capital metrics or when we’re talking about the ‘S’, what we’re really talking about are components that ultimately impact the business’s bottom line. The more clear a company, a business, can get on how to measure, how to drive performance against the ‘S’, we’re also seeing that that translates into long-term value.

“JUST Capital has our JULCD, which is our large cap diversified index, and it’s composed of the top 50% of the Russell 1000, really sort of measured against JUST methodology and scale that we use to inform our JUST 100, which captures the top performing companies in the rest of 1000 when it comes to just business practices.

“And we’ve seen the JULCD outperform its benchmark by 6-7% since its inception. And so I think the reality is that drive and the shift has a lot to do with the fact, too, that folks are starting to understand the real risks and opportunities associated with the work.”

How are the rating agencies interpreting ‘S’ data without any documented standards or measurements?

“It’s all about getting data that’s trendable, measurable, and can challenge the score.” – Wayne A. Seaton

Wayne A. Seaton: “There are ESG rating providers that provide scores and ratings. Many of these are not regulated, whereas the conventional rating agencies, Moody’s and Fitches, are. So I just want to caveat that.

“Now the uniqueness is that you have different methodologies and you have different sources of data and there are disparities in terms of scores. The scores are not correlated. There’s a study that said that with the conventional rating agency, the correlation was over 95%. And there’s another study that said with the nonconventional, the niche rating agencies or rating providers, the correlation was less than 60%.

“So how are they treating this? Well, some of them have their own IP and their own ways of actually getting and extrapolating data from public sources and turning it into their own scores and methodology. Some of them actually have their own artificial intelligence to create ways of measuring news and other sources.”

“Some are measuring impact using the impact standards schema that’s been established by the UNSDG. So a lot of times there’s a collage, if you will, of some of the social factors within the 17 SDG goals. That’s used to track impact, setting up a base standard of year X, meaning time zero, and then back-testing and then going forward to establish a trend. Many of these factors actually come into the overall rating that a company gets from any of the rating agencies, either conventional or nonconventional.”

What metrics should employers start tracking beyond pay equity and median pay gap? When I speak with investors that are really starting to dig in around this practice for the ‘S’ in ESG, the best ones, they’re getting pretty creative. They’re scraping GlassDoor and looking for signs of toxic culture. They’re looking for CEO ratings that are tanking. But how do you measure that?

“Some of the kinds of data that we look at include not just the impact on workforce, but also what’s the greater community impact, social impact.” – Tolu Lawrence

Tolu Lawrence: “[At JUST Capital], we will soon actually be releasing an Equity and Opportunity ranking. We’re looking at things like whether or not they have re-entry programs, a pay gap analysis, whether there are training or career development programs or employee apprenticeship programs.

“We were finding that some of the top performers were 2.4 times more likely to disclose that they offered an apprenticeship program; 7.3 times more likely to disclose that they had a re-entry program; and 8.2 times more likely to have conducted a race or ethnicity pay gap analysis.

“There are signals or indicators that we’ve identified that we can tie to companies that are really performing strongly in these areas. And those indicators help us identify metrics that we can start to focus on to see how companies are performing and that can provide them a level of insight into where they might want to focus more attention or more resources in order to ultimately have the impact that they’re trying to have within their workforce or even within the communities they reach.”

Tolu provided a list of additional metrics JUST Capital examines, which included:

- Board diversity

- Local school support

- Local employment pipeline

- Worker benefits package

- Work-life balance

- Benefits and 401k quality

- Discrimination controversies

- EEOC violations and worker grievance fines

- Diversity, equity, and inclusion policies

- Workforce demographics

- Career development

- CEO-to-median worker pay

- Wage violations

- Fair pay score

- Fair pay rating

- Median pay gap

What parting thoughts do you have for companies that are listening today, what should they be on the lookout for? What should we expect in terms of next steps?

“In the long term, whether markets are up or down, I believe — this is my opinion — that those companies that pay attention to ESG specifically will outperform those that don’t.” – Wayne A. Seaton

Wayne A. Seaton: “First, watch regulatory developments closely and be prepared to make the shift, the transformational shift from what’s ‘nice to have’ to ‘must have.’ The impact we are seeing is not just with the data in the sustainability offices, but also the finance function, who collects data, who reports it, who actually is responsible for collecting and making standards and communicating to investors.

“But the last thing — no matter if it’s a small company that’s fledgling, whether it’s a B Corp or a private company that’s being prepared for an acquisition by a private equity firm, or a large company that has billions of dollars of assets and hundreds of thousands of employees, it’s all about long-term value and it’s all about measuring and reporting the connection between ESG and, in this case, the ‘S’. So that it not only is appealing to the short-term year, to measurements from the markets, but also the long-term component, which is the employee supply chain. Not just the shareholders. But the stakeholders.”

Want more?

ESG is clearly a hot topic among investors, and likely to become more so. The quotes above are just a few of the top highlights from the webinar — watch the on-demand recording for the full discussion on investors’ perception of the ‘S’ in ESG, how investors are measuring progress, and more. You can also learn more about the ‘S’ in our recent 4-part blog series and infographic.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.