CFOs are tasked with making the most of the resources they have in a dynamic (and challenging) economic environment. This makes efficiency top of mind right now as companies navigate the start of a new budget season.

As you prepare for this year’s budget cycle, you have an opportunity to partner with your CFO in a new way. While HR is typically tasked with attracting, retaining, and engaging employees, the Chief Financial Officer plays a unique role in strategically allocating resources and helping shape the investments needed to accomplish talent goals in a hypercompetitive business environment.

Learn how partnering with your CFO can help your organization drive sustainable change and advance workplace equity.

Why CFO buy-in for workplace equity matters

CFOs know the financial impact of talent management. Employees are often a company’s greatest asset and greatest expense. As guardians of the bottom line, CFOs recognize workplace equity’s impact on retaining and promoting their organization’s best employees without bias and hitting diversity benchmarks critical to board members and ESG-driven investors. As an executive sponsor for workplace equity, your CFO can help you capture the business case for workplace equity and shape the potential investment your company will apply to it.

CFOs know the power of analytics. By applying their analytical lens to workplace equity programs, CFOs can ensure that the underlying data analytics have sufficient rigor, accuracy, and timeliness. Leading CFOs actively:

- Drive digital transformation of outdated HR, Total Rewards, and DEI processes by supporting investments in software solutions purpose-built for workplace equity analytics.

- Demand the same statistical rigor and analysis for people data that is leveraged for every other area of the business. Companies that are not able to get real-time, data-driven insights into their people are falling behind.

- Advocate for dedicated budgets and resources to fuel workplace equity programs.

- Collaborate with HR to establish KPIs for workplace equity initiatives and define measurable ROI through tangible business outcomes, such as reducing pay equity remediation costs over time, improving employee sentiment and retention, and helping attract top talent.

- Assess hard metrics for reporting on progress to the board, investors, employees, and external stakeholders, emphasizing transparency and accountability.

Convincing your CFO to partner with you in workplace equity

Convince your CFO by presenting a compelling business case that aligns workplace equity with financial outcomes and long-term success. Here are key strategies that can help facilitate CFO buy-in:

Quantify the business impact. At the end of the day, CFOs are focused on the bottom line and need concrete evidence of how workplace equity initiatives contribute to the company’s financial success. HR and Total Rewards leaders must gather and present data that demonstrates the correlation between workplace equity and positive business outcomes. This includes showcasing how a diverse and inclusive workforce improves employee productivity, enhances innovation, reduces turnover costs, and strengthens the company’s employer brand. You can make a persuasive case for workplace equity investments by highlighting benefits such as:

- Workplace equity is a key component of keeping your current workforce engaged and productive, as employees who work in a high fairness environment have 26% higher performance and a 27% lower chance of quitting. It’s also important for attracting new talent: 67% of job seekers overall look at workforce diversity when evaluating an offer.

- Research shows companies that prioritize workplace equity and have more diversity, especially in senior leadership roles, financially outperform their peers. For example, companies that disclose they’ve conducted a pay equity analysis report nearly 8% higher mean five-year Return-on-Equity, while teams that shift to even gender representation generate 41% more revenue.

→ Looking for more stats supporting the business case for workplace equity? Check out our infographic

Align with strategic objectives. CFOs are more likely to support workplace equity initiatives when they align with the company’s strategic goals and objectives. HR leaders should clearly articulate how equity initiatives contribute to the achievement of key organizational priorities and the company’s growth strategy. For example, if the company aims to expand into new markets or attract a broader customer base, emphasizing the importance of diversity and inclusion in driving these goals can resonate with CFOs. According to a 2023 study from TechTarget’s Enterprise Strategy Group (ESG) conducted, commissioned by Amazon Web Services, “Organizations that invest in diversity, equity, and inclusion (DEI) programs are seeing positive business outcomes such as better competitive position, increased agility and innovation, and better brand perception.”

Utilize workplace equity data analytics software to improve efficiency and generate clear metrics and reporting. CFOs appreciate data and metrics that demonstrate the return on investment (ROI) of any initiative. Through automation, workplace equity analysis software can help improve efficiency by requiring fewer resources and less time for analyses, as well as reducing remediation costs over time by helping to identify and address root causes of inequities. HR and Total Rewards leaders should develop comprehensive measurement frameworks alongside software analytics in order to track and report on the impact of workplace equity initiatives. By quantifying outcomes, such as improved employee engagement, reduced turnover rates, and decreased pay equity remediation costs, HR/Total Rewards can provide the CFO with tangible evidence of the financial value generated through workplace equity investments.

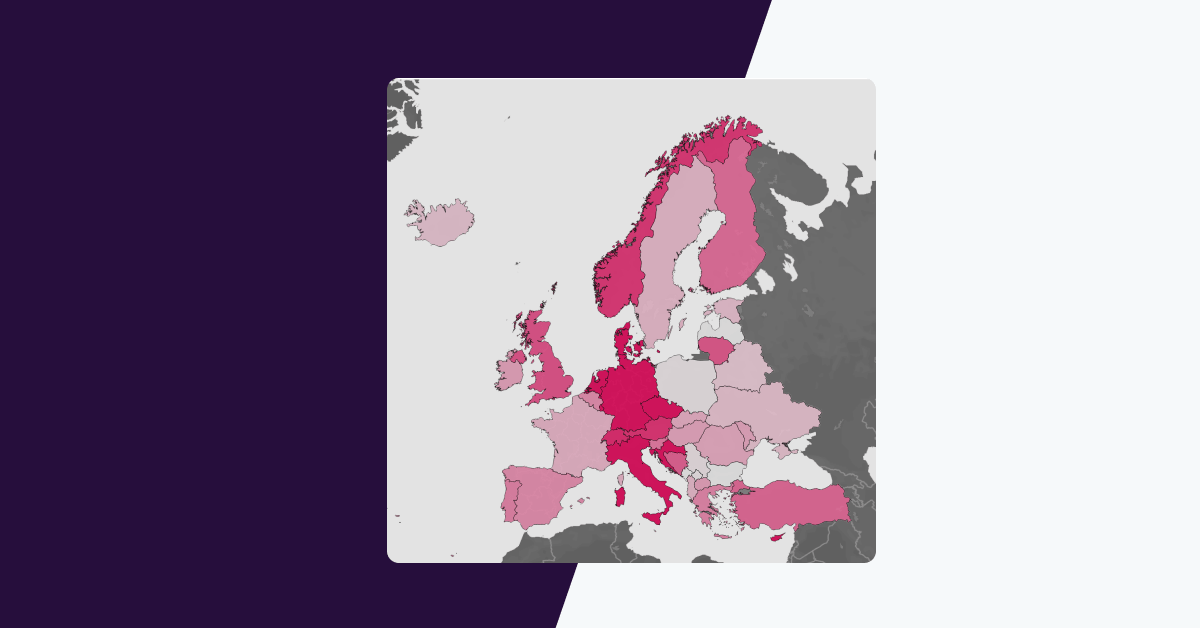

Emphasize regulatory and legal compliance. Workplace equity is an area of great financial and reputational risk. HR leaders should educate CFOs on the evolving legal landscape and the potential legal risks and financial repercussions of non-compliance. By highlighting the potential cost savings and risk mitigation that come with robust workplace equity programs, HR can garner CFO buy-in by framing it as a necessary investment to safeguard the company’s financial health.

Leverage external influences. CFOs are keenly aware of pressures from external stakeholders, including investors, customers, and business partners. HR and Total Rewards leaders should highlight the growing expectations from these external entities regarding workplace equity and the impact on the company’s reputation and market position. By emphasizing the potential positive effect on the company’s employer brand, shareholder value, and investor confidence, HR/Total Rewards can demonstrate that workplace equity initiatives are not only a moral imperative but also a strategic advantage in a competitive business landscape.

The case for workplace equity

“The CFO really has the lens of taking a look at the workplace equity initiatives and making sure that there’s the right level of rigor, accuracy, real-time data and metrics… And the best way to do that is to make sure the CFO supports investments in software solutions that can allow the company to take control back and be able to report on its data and metrics in real time as needed.”

Obtaining CFO buy-in for workplace equity initiatives and investments requires HR leaders to present a compelling business case grounded in financial outcomes. By quantifying the business impact, aligning with strategic objectives, emphasizing compliance, utilizing software for data-driven metrics, and leveraging external influences, HR can effectively engage CFOs and secure their support. With CFOs on board, companies can proactively invest in workplace equity to drive positive change.

Want to learn more about how workplace equity pays off? Check out our video series showcasing how major brands like American Airlines, Indeed, and Moderna prioritize workplace equity to make a real difference for their people, brand, and their business.

The information provided herein does not, and is not intended to, constitute legal advice. All information, content, and materials are provided for general informational purposes only. The links to third-party or government websites are offered for the convenience of the reader; Syndio is not responsible for the contents on linked pages.